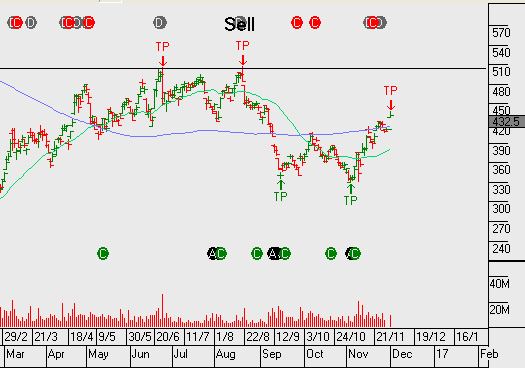

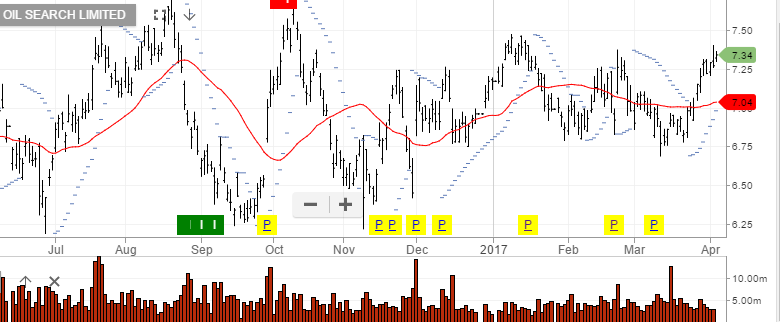

Sell Oil Search Near Resistance

After posting a four-month low at $47.10 on March 27th, WTI Crude Oil has rallied to close at $51.10 today.

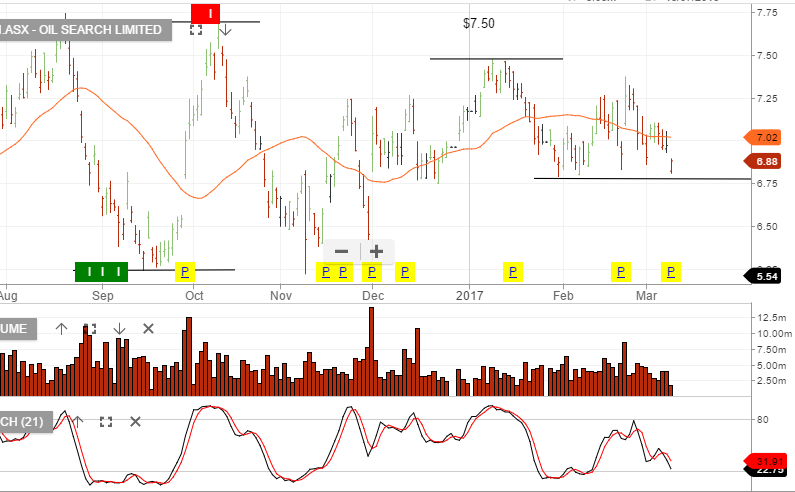

Shares of Oil Search have followed crude higher moving from $6.90 to a three-month high of $7.34 in early trade.

We see scope for a move back to the $7.70 level over the near-term. This would represent a “double top” technical pattern which usually serves as price resistance.

In this case, a move up to $7.70 would give investors a chance to take profits on long positions or write covered calls to enhance portfolio returns.

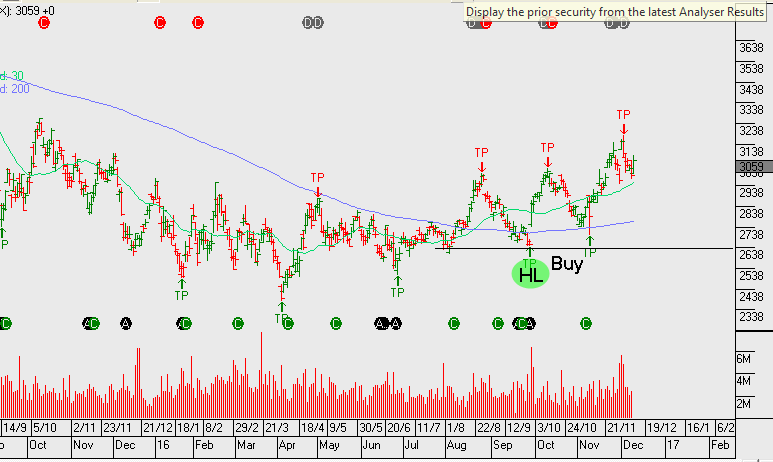

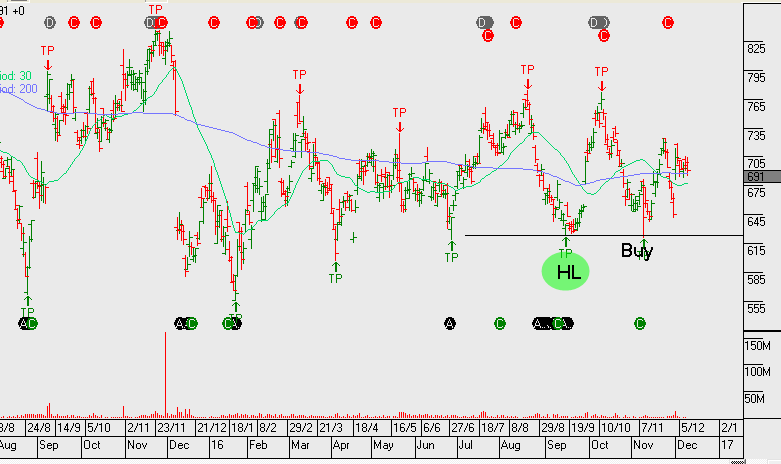

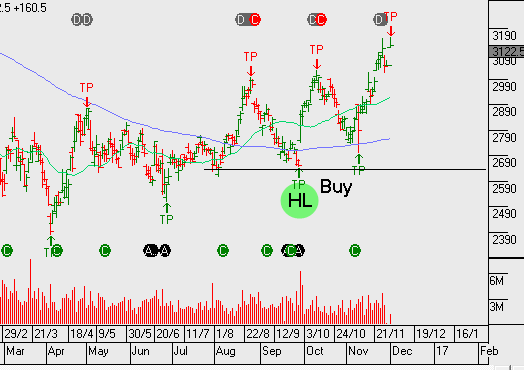

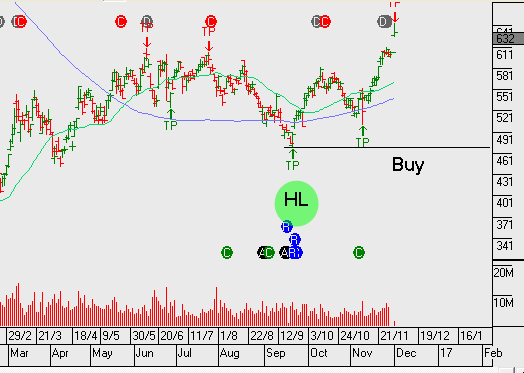

We recognize that the energy sector has some level of upside momentum, for now, and stocks like BHP and Origin on our buy side radar.

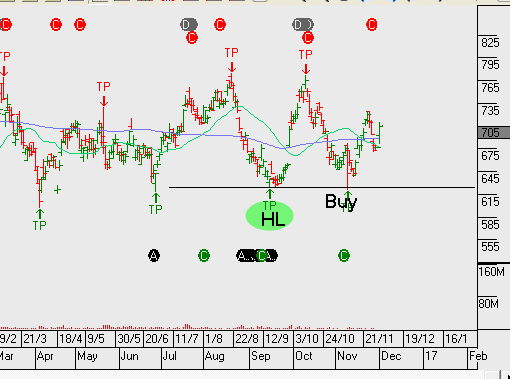

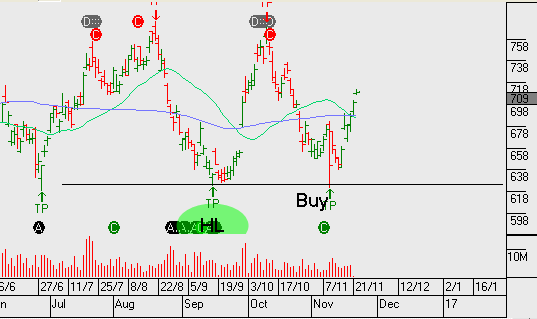

Chart Oil Search

Chart Oil Search