RIO – 1H17 Earnings

RIO reported 1H17 underlying earnings of US$3.9bn, which was largely in line with market expectations. EBITDA of US$9.0bn was also in line.

Lower capex resulted in cash flow and net debt coming in slightly better than exceptions (gearing now 13%) with net debt end of June US$7.6bn.

Buy-back was boosted by US$1.0bn increase, helping to offset a softer interim dividend. The interim dividend announced was US$1.10 and assumes 50% payout ratio.

In 2018 we expect RIO to see flat earnings growth at best, and we have the stock trading on a forward yield of 4.5%.

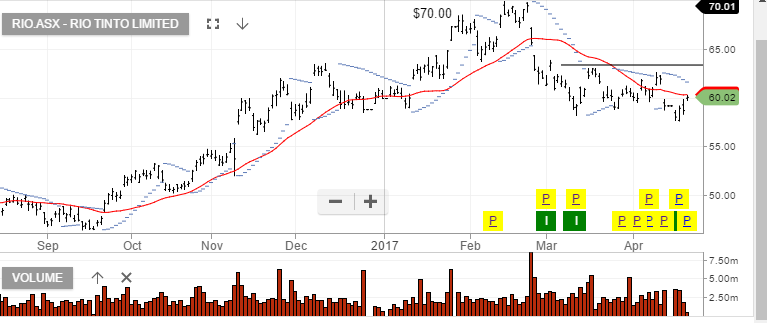

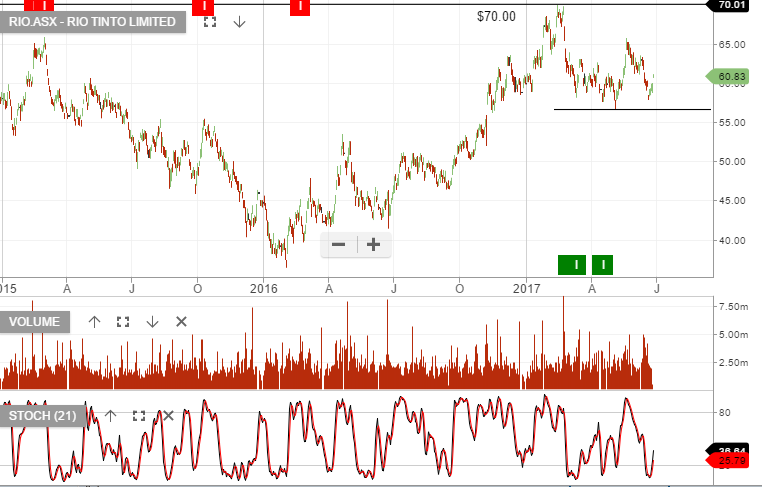

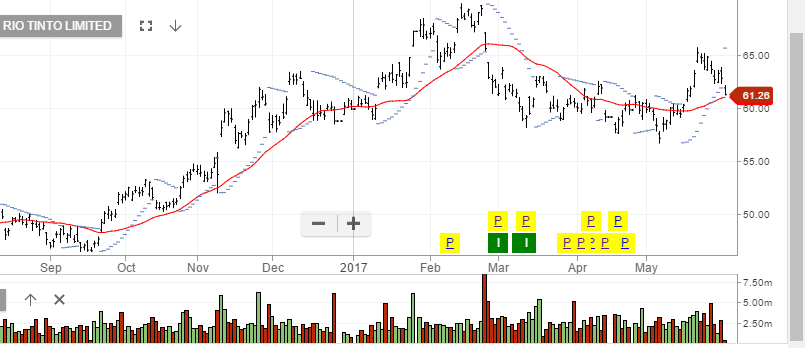

Rio Tinto

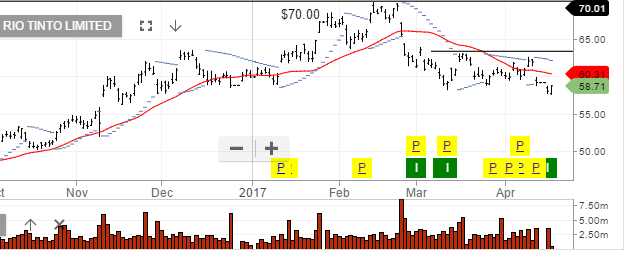

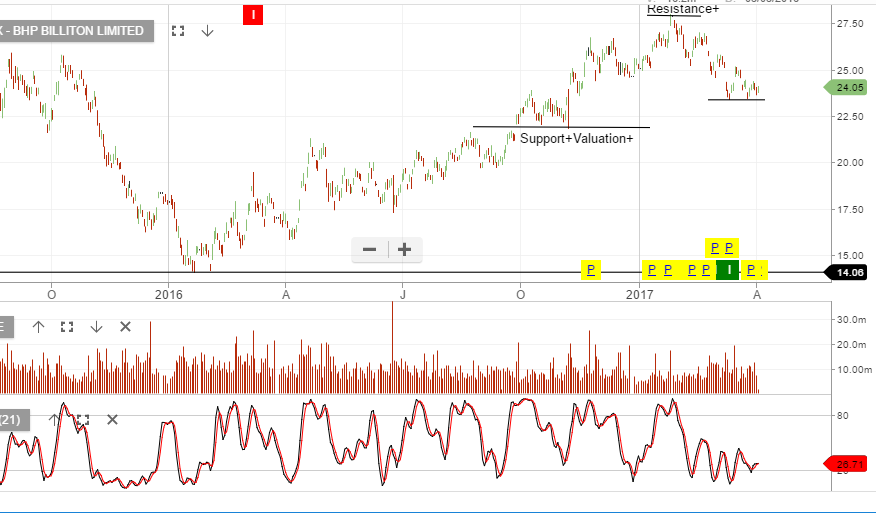

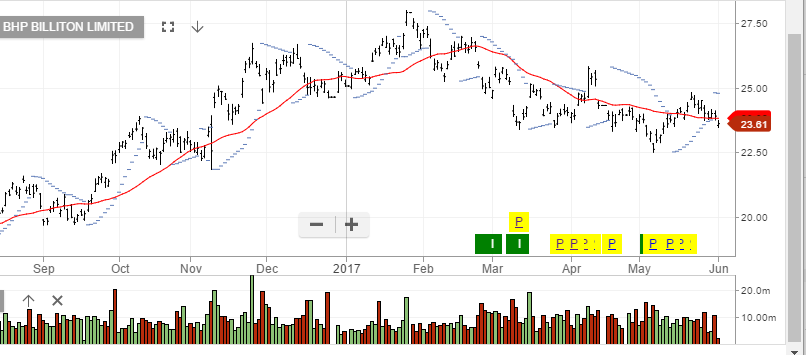

Rio Tinto BHP

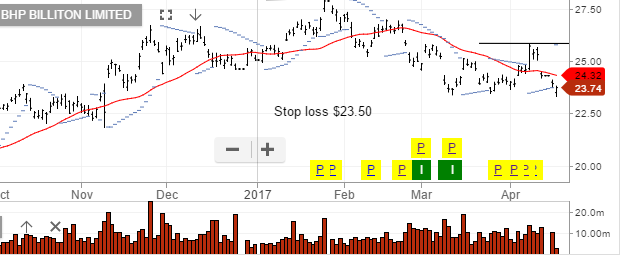

BHP