ResMed – Opportunity Approaches

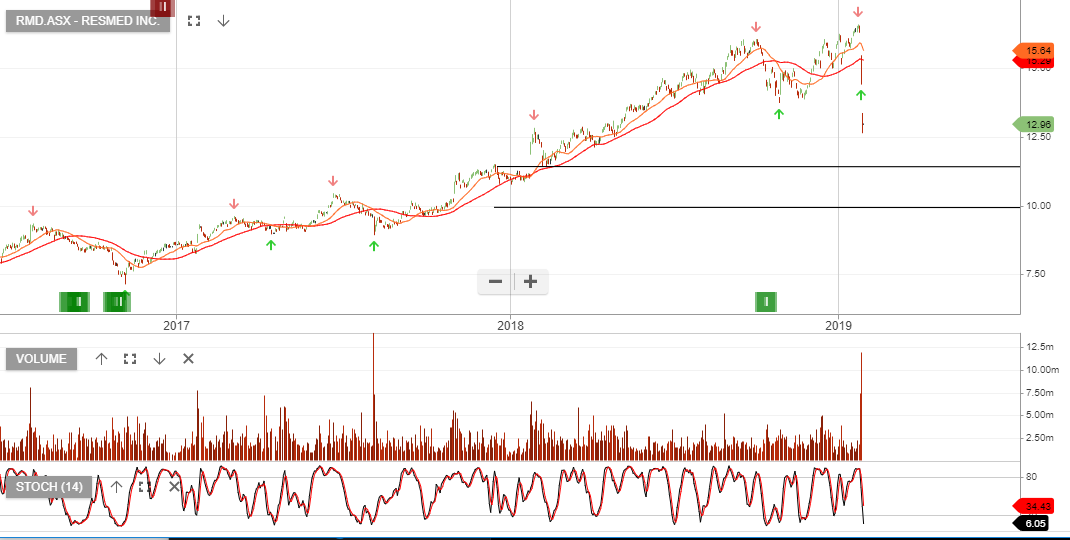

ResMed is a current holding in our ASX 100 model portfolio.

The company reports 1Q20 earnings on 25 October and we expect revenue growth to be 15%+ and EBIT to be up 10%+ on the same time last year.

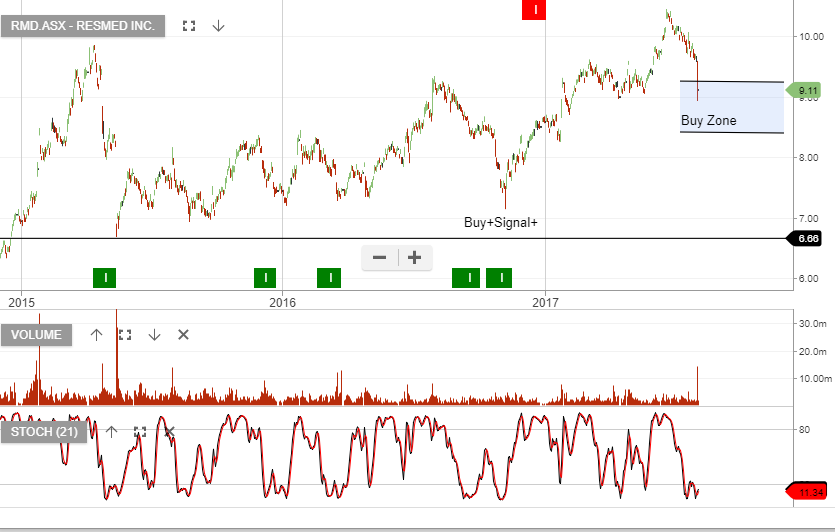

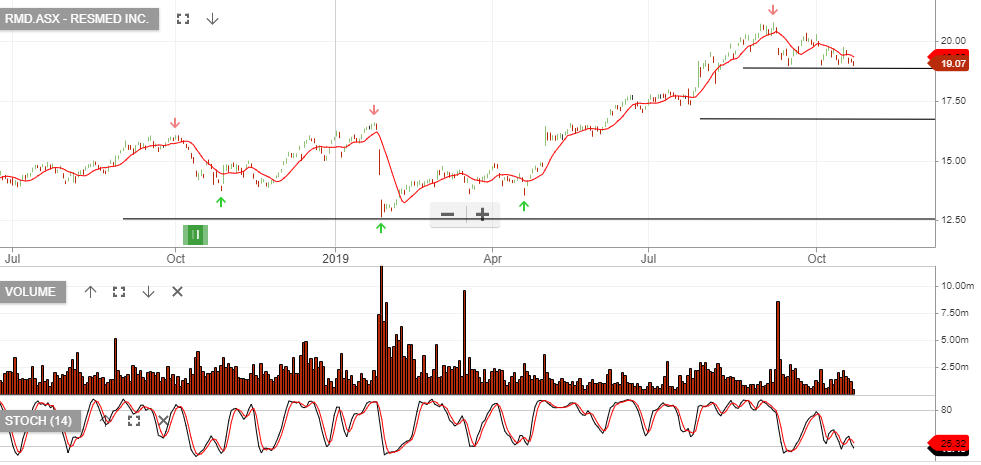

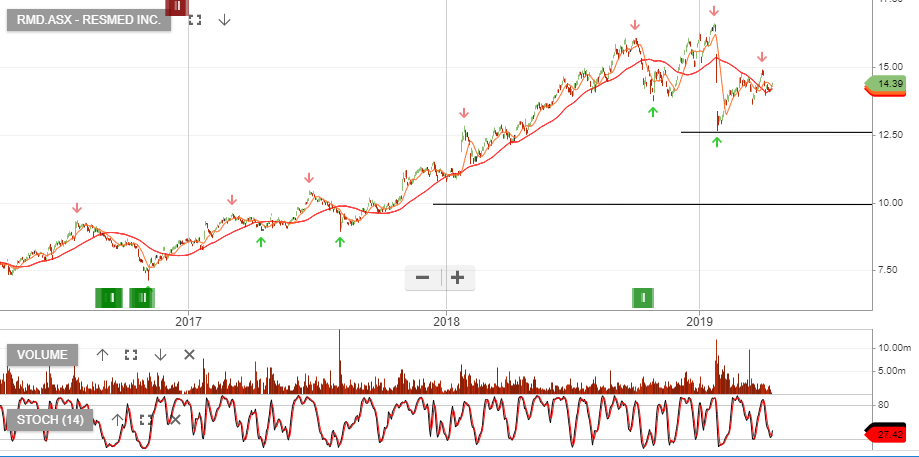

We look for an entry-level into RMD on the current price weakness and will update our readers further, following the earnings result.

Resmed

Resmed