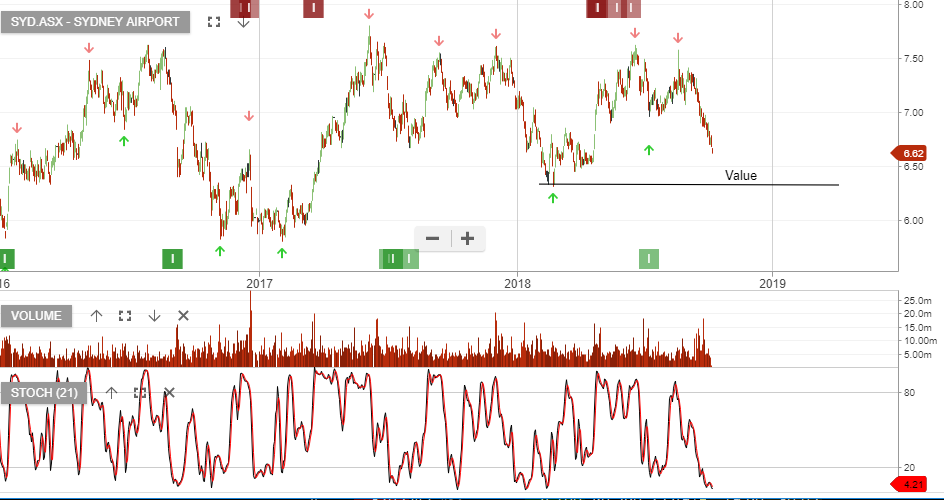

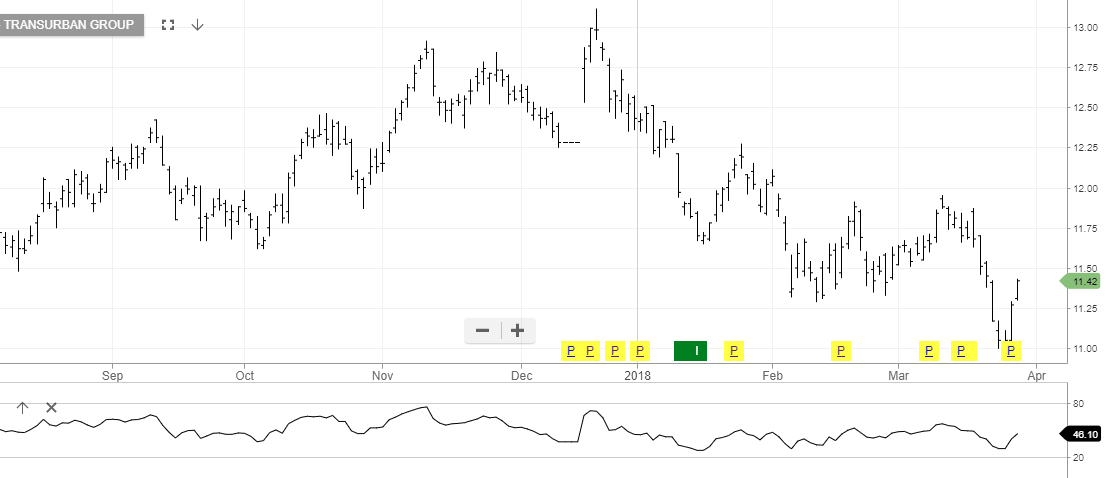

Our Algo Engine has the following group of REITs under buy conditions CHC, DXS, GMG, GPT, LLC, SCG, & VCX. These names all sit in the ASX 100 model portfolio.

Chart Hall Group is the best performing REIT within our models, up 54% after holding it for 574 days.

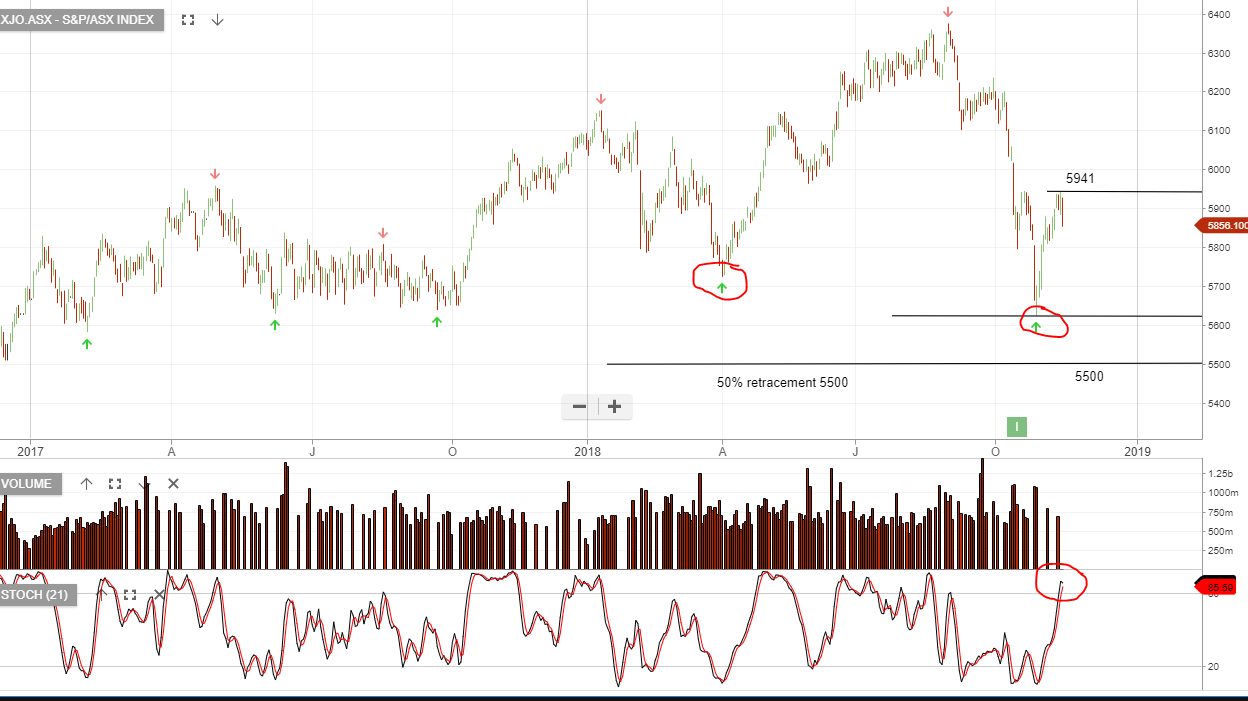

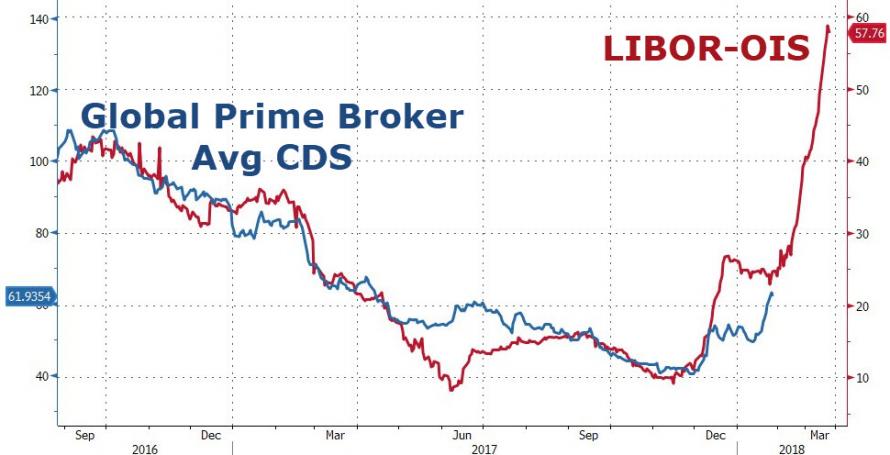

REITs have performed very well in recent weeks, due to the moderating outlook for bond yields. If yields remain under pressure, defensive asset

classes, such as A-REITs and utilities will outperform through 2019.

A slowing global growth picture, low bond yields, rising equity market volatility are generally seen as positive catalysts for defensive sectors. The recent run up in these names means much of the value has already been captured. Therefore, we recommend investors use covered call options to enhance the income return.

As an order of preference, we feel large scale logistics, followed by office and then residential.

EPS growth for the sector is running around 4 -5% and dividend yields are near 5% also. Add a covered call and you’re able to achieve 10% annualised cash flow.

For more detail on covered call strategies please call of our office on 1300 614 002.

CHC

SLF Property ETF