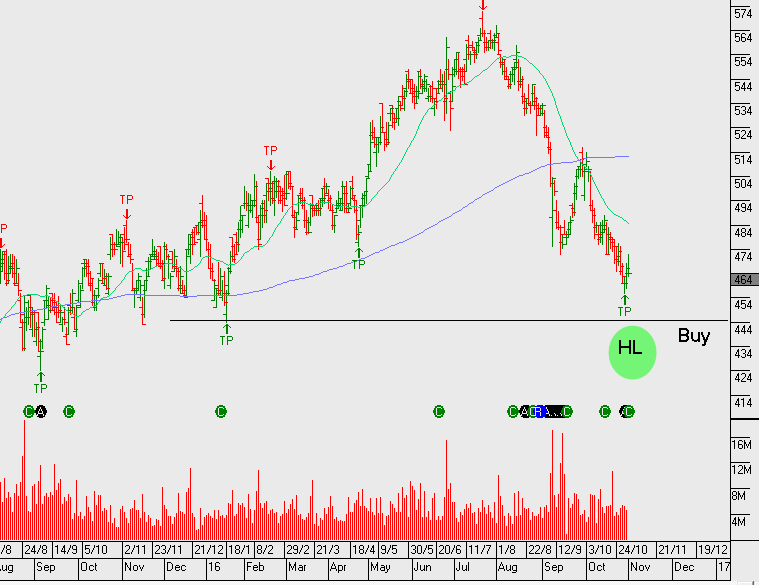

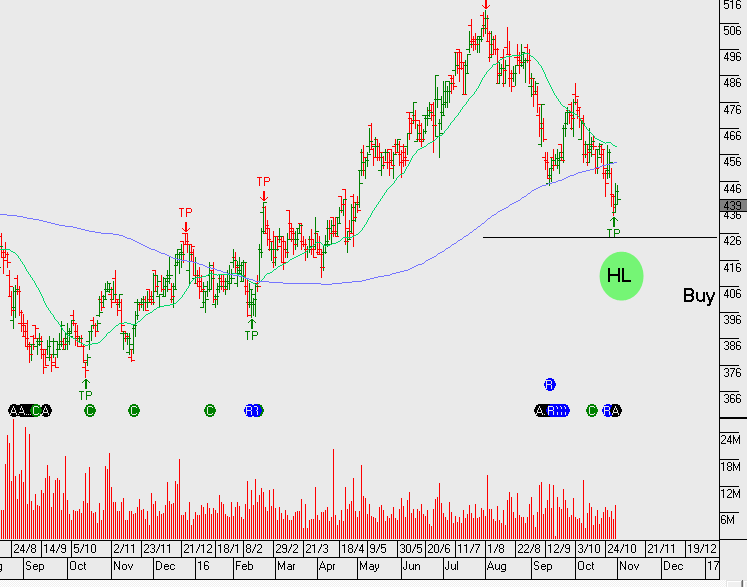

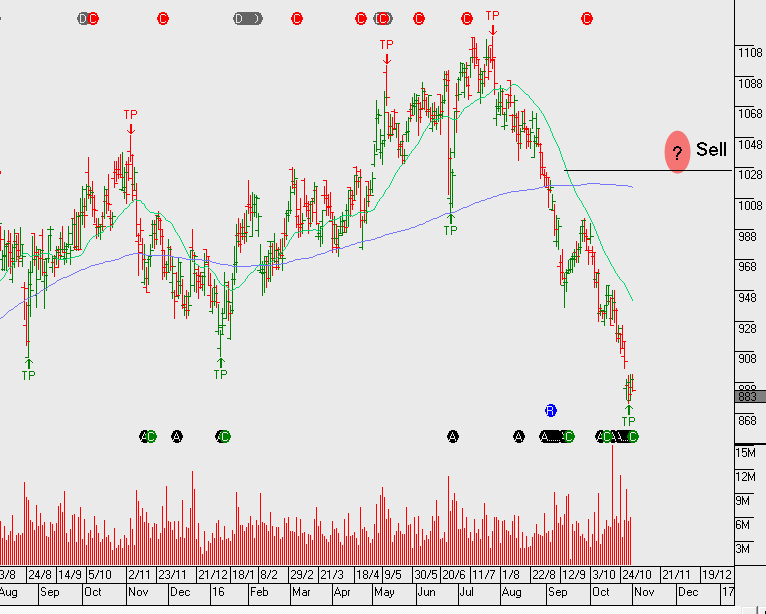

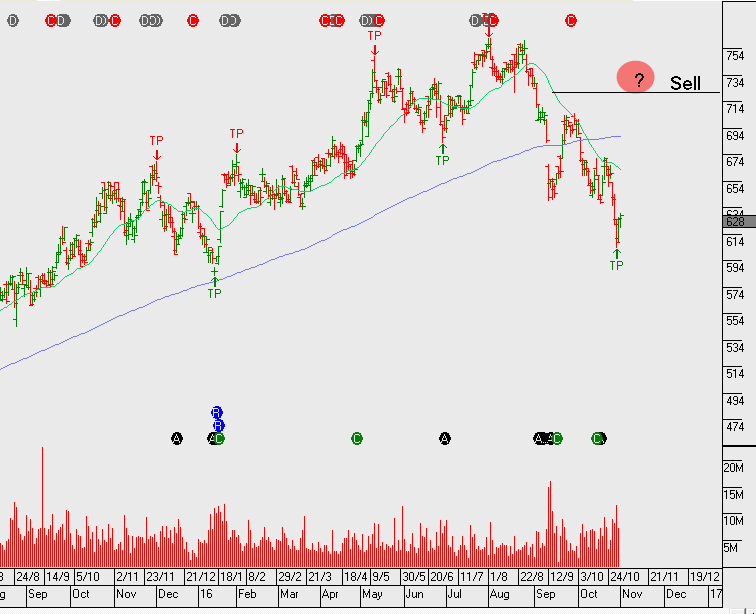

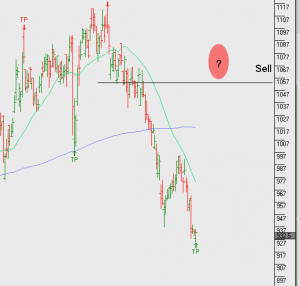

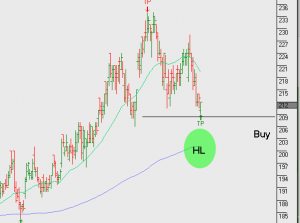

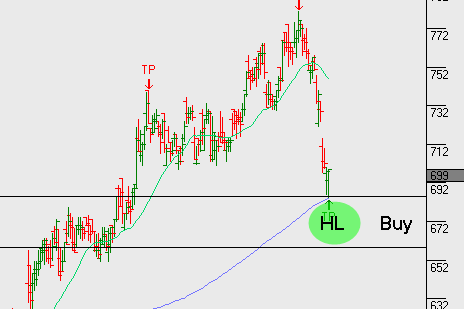

Yield Names Remain Under Pressure

Yield sensitive names remain under pressure as the bond sell-off in the US continues. As bond prices trade lower, the yield is increasing. Higher yields, make interest rate sensitive names like infrastructure and property trusts less appealing.

The sell-off in domestic names such as APA, GMG, GPT, SGP, TLS, TCL, SYD, WFD & SCG has been significant. With many of these names now trading on yields within 4.5 to 6.5% range.

There’s a case to be made for the above stocks to find support as the outlook for interest rates begin to stabilise.