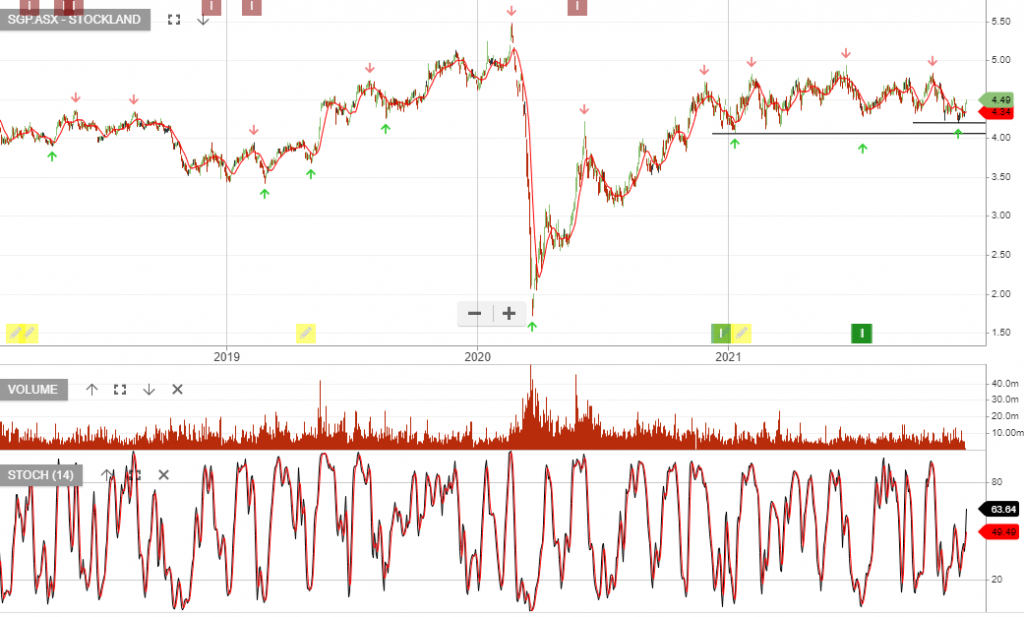

Stockland – Buy

is under Algo Engine buy conditions and we see buying interest building above the $4.20 support level.

1Q22 Update and Reconfirming Guidance:

FY22 estimated FFO per security forecast in the range of 34.6 to 35.6 cents. Distribution per security is forecast to be within our target payout ratio of 75% to 85% of FFO.

Current market conditions remain uncertain and challenging with ongoing lockdowns and community transmission of COVID-19. All forward looking statements including FY22 earnings guidance are provided on the basis that the vaccination roll out continues and COVID-19 restrictions ease towards the end of CY21 and are underpinned by the following business assumptions:

• Residential settlement around 6,400 lots

• Residential operating profit margin ~18%

• Land Lease communities delivering ~300 sites in FY22

• Retail rent collection returning to levels experienced prior to recent lockdowns towards the end of CY21

SGP – Algo Buy Signal

has switched to Algo Engine buy conditions and has now been added to our ASX 100 model portfolio.

Stockland, has formed a joint venture partnership with JP Morgan Asset Management to acquire a portfolio of industrial properties that they will expand over the next three years. The focus will be the faster growth opportunities within logistics and fulfillment centers.

SGP – Algo Buy Signal

REITs in Review

A number of REITs announced their 3Q19 operational updates yesterday.

Dexus forecast 5% underlying earnings growth. reaffirmed its FY19 guidance for 5% growth.

Mirvac indicated their FY19 guidance will be in the 3 – 4% growth range with DPS growth at 5%.

Across the sector it is likely residential and retail remain the weak spots, whilst office and industrial will continue to provide strong growth. Softening of the retail sector was evident in GPT’s March quarter business update.

Despite GPT’s exposure to retail, the office exposure along with the groups strategy to expand the footprint in logistics, makes the stock one of our preferred opportunities within the REIT sector.

Property Stocks Find Buying Interest

As the US yield curve flattens, which is caused by the long-end of the curve no longer increasing at the same rate as the shorter-end, we’ve started to see institutional money flow back into ASX listed yield sensitive names.

Our preference among these, within the property sector is GPT, SGP, and WFD, (based on valuation grounds).

Within Utilities and Infrastructure, we continue to like AGL, SYD and TCL.

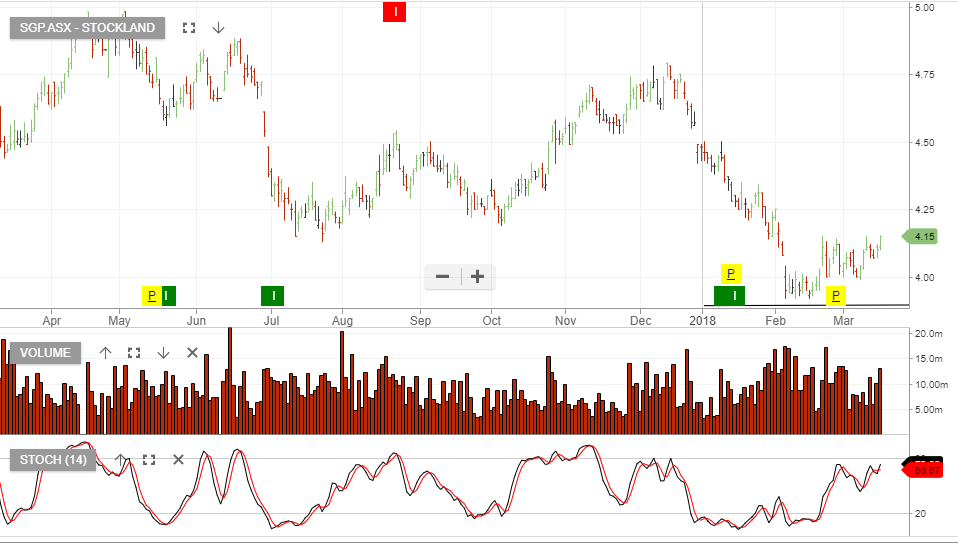

Stockland – Algo Update

Stockland was added to our ASX 50 model in January and we’ve continued to accumulate the stock in recent trading sessions.

The latest earnings result continued to show strong momentum in residential property sales which should help support a move back to $4.40

SGP is forecast to pay $0.13 dividend in June which places the stock on a 5.5% annualised yield.

Stockland Corporation

ALGO Buy Signal For Stockland Corporation

Our ALGO engine triggered a buy signal for Stockland Corporation at $4.28.

Like several of the ASX interest-rate sensitive names, the SGP share price has dropped more 10% over the last month.

With over $16 billion in real estate assets across the country, SGP is Australia’s largest residential property developer.

We believe that the company’s diversified community development model will insulate the firm from a downturn in the higher-end property market and support a higher share price.

The technical “higher low” pattern is based on the July lows near $4.00. With a year-on-year dividend expected in the 26 cent range, this puts the stock yield at around 5.5% at current prices.

Stockland

Stockland

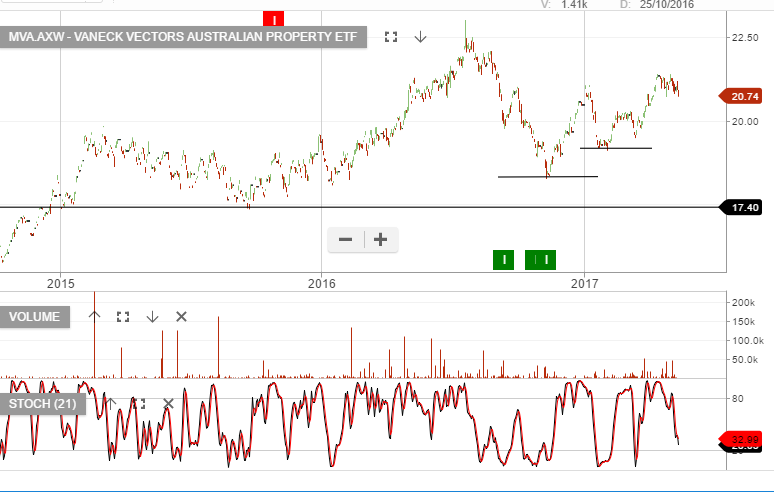

Property Stocks Under Pressure

After the strong rally in SGP, LLC, GPT and MGR, the price action looks to be rolling over, pointing lower, and we’ll watch these names closely. SGP appears to be showing the most selling pressure with the current price action taking out the 4.74 low formed on the 26th of April.

Our Algo Engine generated a buy signal on MVA.AXW (Vaneck Vectors Australian Property ETF) back in November at around $18.40, the ETF traded up to $21.30 and in the last week it’s starting to run into selling pressure.

Stockland – 1H17 Earnings Release

Diversified REIT, Stockland Corporation, announced a 7.8% rise in its underlying earnings after posting record turnover in its residential division; primarily from the East coast of the country.

Stockland said revenue from operations reached $369 million, which is is tracking toward the upper end of its guidance for 5 to 7% revenue growth in 2017.

The company announced an interim dividend of 12.6 cents per share, compared to a 12.2 cent dividend for the same period last year.

Send our ASX Research to your Inbox

Or start a free thirty day trial for our full service, which includes our ASX Research.