Star Entertainment

The Star Entertainment Group has been thrown a lifeline by the New South Wales government in the form of a “transitional” tax levy for the next seven years.

This will help Star finalise its funding arrangements.

The Star Entertainment Group has been thrown a lifeline by the New South Wales government in the form of a “transitional” tax levy for the next seven years.

This will help Star finalise its funding arrangements.

The Star Entertainment Group has been thrown a lifeline by the New South Wales government in the form of a “transitional” tax levy for the next seven years.

This will help Star finalise its funding arrangements.

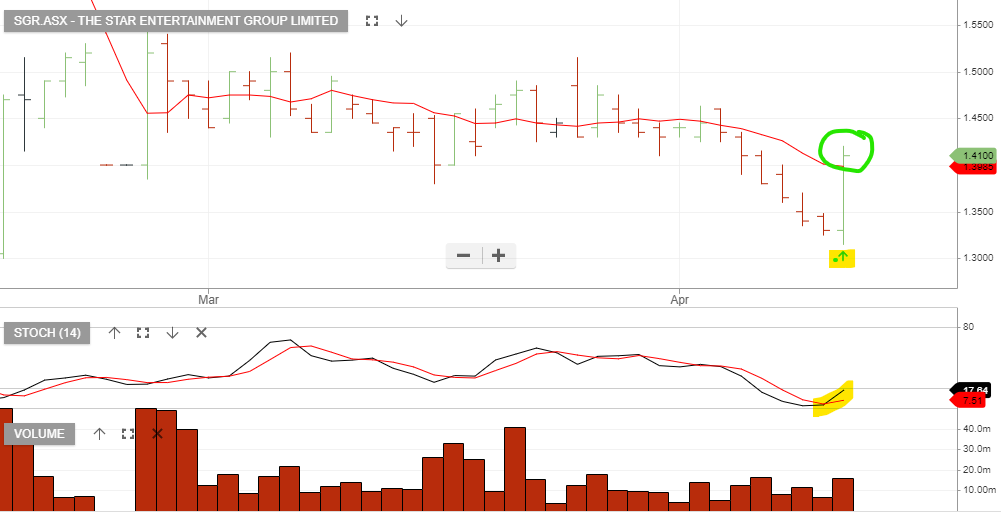

The Star Entertainment Group experienced above-average volume and a strong close in yesterday’s session.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

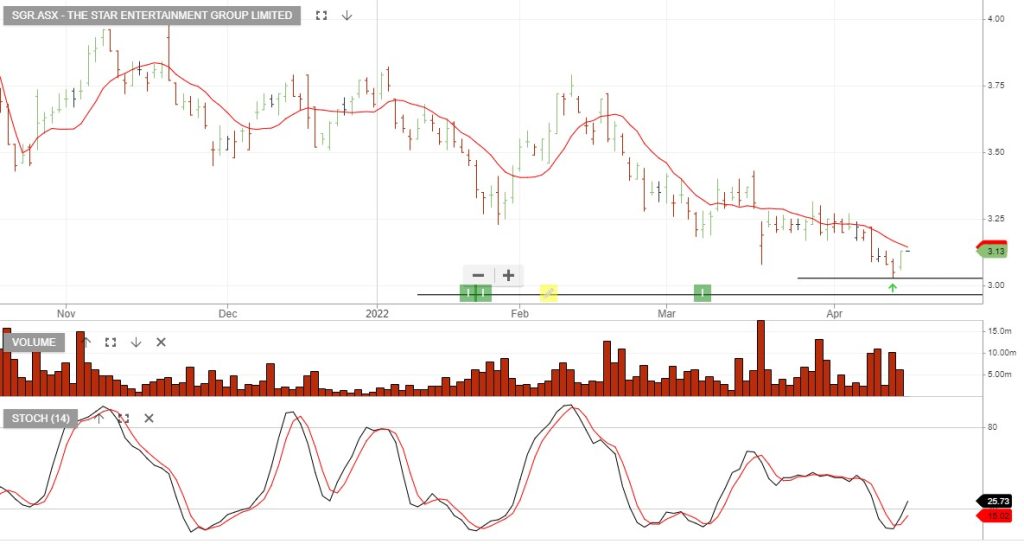

The Star Entertainment Group is under Algo Engine buy conditions.

The Star says it expects to see strong revenue growth under normalising business conditions.

15/4 update: The share price is trading within our forecast trading range and we’re now monitoring the short-term price action and momentum indicators for signals of increased buying activity.

The Star Entertainment Group is under Algo Engine buy conditions.

The Star says it expects to see strong revenue growth under normalising business conditions.

15/4 update: The share price is trading within our forecast trading range and we’re now monitoring the short-term price action and momentum indicators for signals of increased buying activity.

The Star Entertainment Group is under Algo Engine buy conditions.

The Star says it expects to see strong revenue growth under normalising business conditions.

15/4 update: The share price is trading within our forecast trading range and we’re now monitoring the short-term price action and momentum indicators for signals of increased buying activity.

Or start a free thirty day trial for our full service, which includes our ASX Research.