Shares of Star Entertainment have reclaimed the $5.00 handle for the first time in three weeks as investors get positioned for the FY 2018 earnings report due out on August 24th.

Over the last two weeks, SGR has had nine buy ratings and two hold ratings from local broker names.

The company operates casinos in Sydney, Brisbane, the Gold Coast and also manages the Gold Coast Convention Center on behalf of the Queensland Government.

SGR is one of the largest beneficiaries of tourism inflows into Australia, which means their hotels and developments could significantly raise future earnings.

The stock is currently trading at 8.7X FY19e EBITDA and we believe their FY 2018 earnings could surprise to the upside.

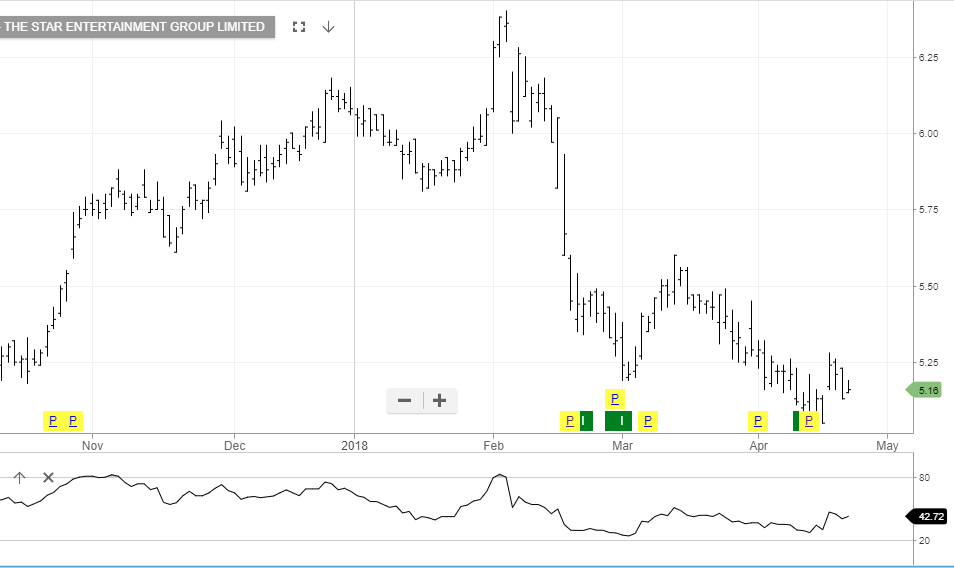

SGR was added to our ASX Top 100 portfolio and we see scope for a move back into the $5.70 range over the medium-term.

Star Entertainment Group