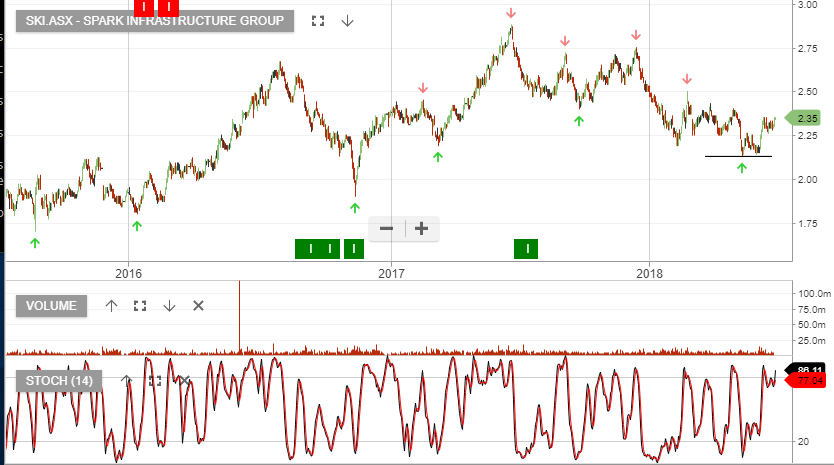

Spark – Valuation Review

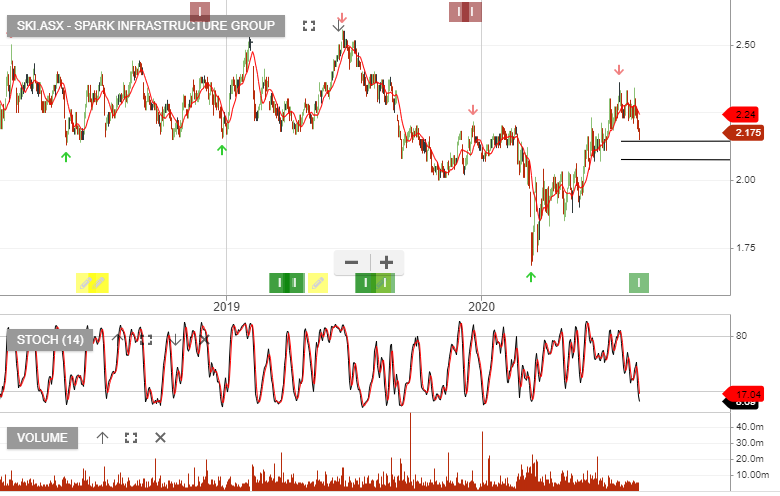

Spark Infrastructure is under Algo Engine buy conditions following the higher low support at $2.10.

1H20 earnings delivered slightly better growth than expected with full-year DPS guidance unchanged at $0.135. EBITDA increased 4% to $430m.

Cash flow was weaker than expected and we see slight downside pressure on the dividend in FY21 & FY22.