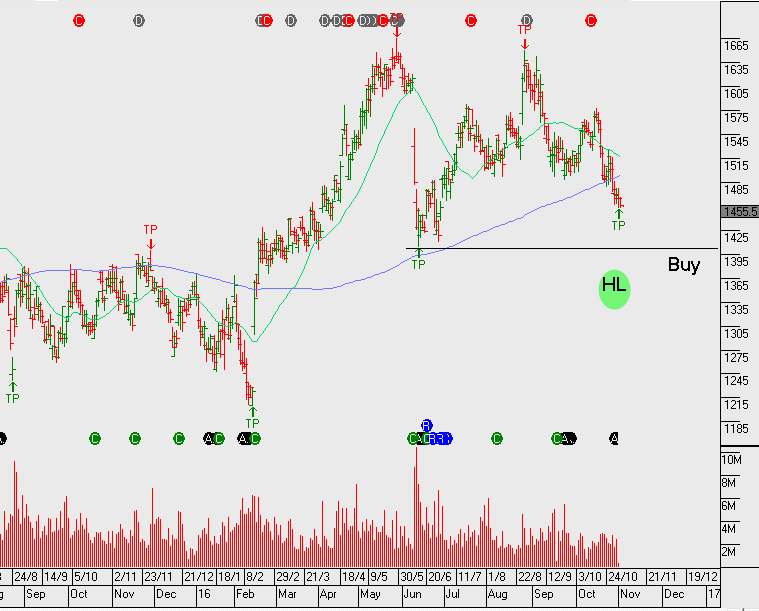

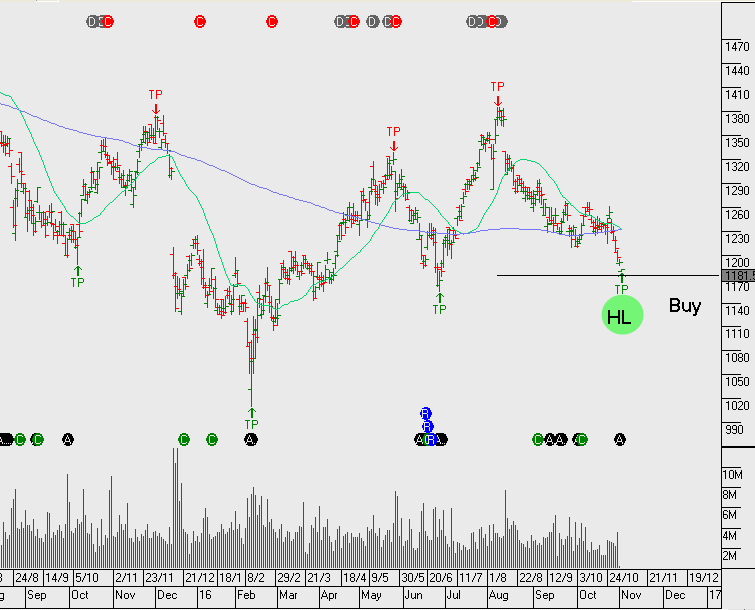

Suncorp – Holding Support

After a series of lower high structures over the past 2 years Suncorp looks to have found a short-term consolidation range with $12.75 support and $14 resistance.

We recently took profit in our long Suncorp exposure when the stock was last trading $13.75. The stock is now back on our watch list but a break below $12.75 will show the downtrend remains the primary driver.