Sydney Airports – Buying Interest

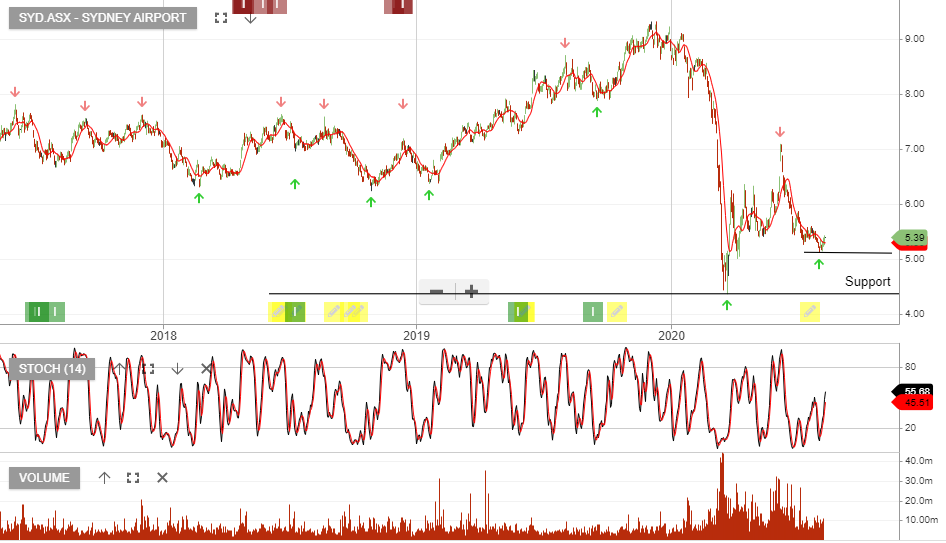

Sydney is now under Algo Engine buy conditions and we highlight the buying interest which is now building.

Sydney is now under Algo Engine buy conditions and we highlight the buying interest which is now building.

Following the entitlement offer Sydney net debt position will reduce from $9.1 billion to $7.1 billion. Post the capital raising, available cash will increase to $4.6 billion.

New securities under the final allotment commence trading on 14 September.

Sydney will raise up to $2bn through a renounceable one-for-5.15 rights issue at $4.56 a share, which is a 15% discount to the last close and underwritten by UBS.

SYD reported a half-year loss of $53.6 million, with no interim dividend declared. Revenue down 36% to $511m and EBITDA down 35% to $300m.

Sydney is a current holding in our ASX 100 model portfolio.

We’re watching Sydney Airport for buying interest to rebuild within the $5.25 to $5.50 range.

Sydney is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

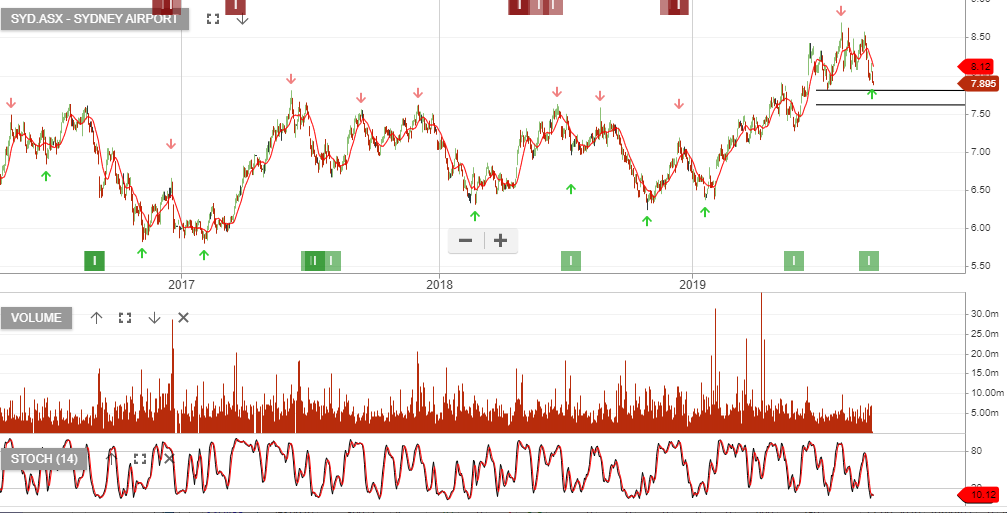

We see buying support building between $7.80 and $8.00. On a rally back to $8.50, investors should consider selling a European call option into early 2020 to enhance the income return.

SYD goes ex-div $0.19 on the 28th of December.

We recommended buying Sydney at $7.45 and the share price is now trading $7.75.

Selling a September $7.76 Euro call option will enhance the cash flow by an additional $0.19 per share.

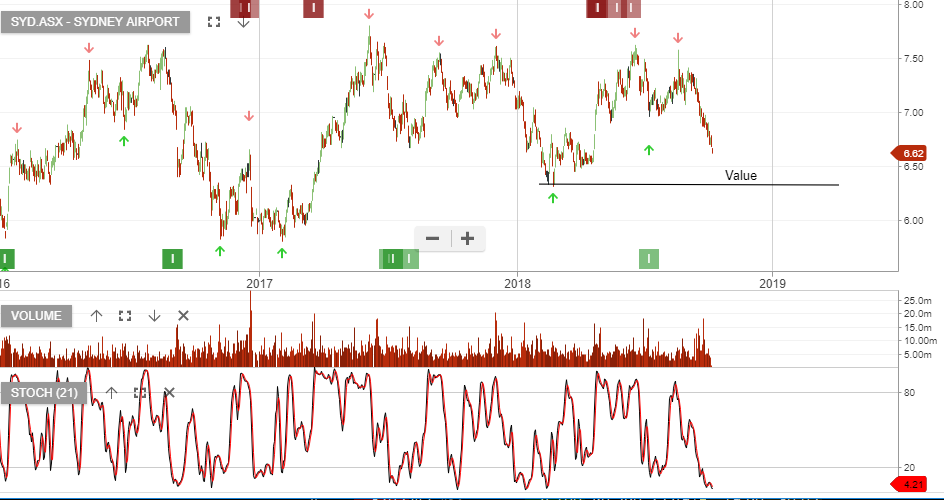

SYD goes ex-div $0.195 on the 27th June.

We recommend buying Sydney at current levels and selling a September $7.75 call option to enhance yield.

SYD goes ex-div $0.195 on the 27th June.

During the recent run-up in US interest rates, yield sensitive names have faced heavy selling pressure over the last 8 weeks.

However, as a “risk off” wave now appears to be hitting equity markets, it’s likely bond yields will consolidate, and in the process provide some selling reprieve for the yield sensitive names.

SCG and SYD are two examples where we now feel the prices reflect good value.

Sydney Airport

Scentre Group

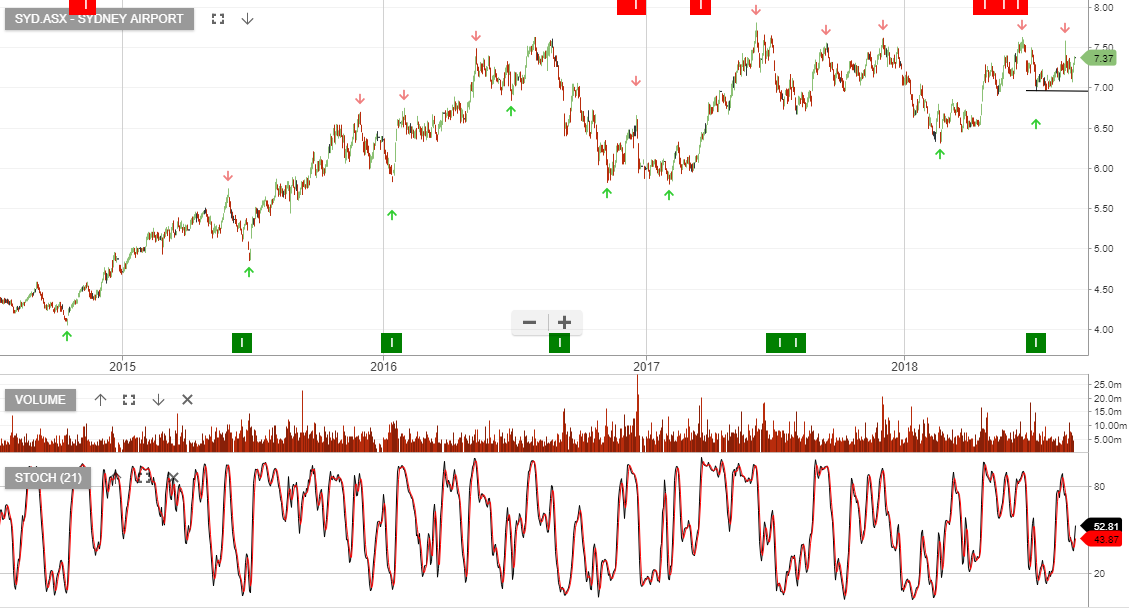

Our ALGO engine has been long SYD since July 12th from $7.05.

After a brief rally to $7.60 in late August, the share price is just below $7.00.

SYD reported solid passenger growth in August with a 5.1% increase in travellers year to date.

For H1 2018, SYD spent $180 million on capital upgrades aimed at increasing capacity including landing strip and terminal expansions.

We see good technical support in the $6.70 area with an upside target of $7.80 over the medium-term.

Sydney Airport

We recommend buying Sydney Airports at current levels and selling a March $7.50 call option to enhance yield.

SYD goes ex-div $0.18 on the 28th December

Sydney Airports

Or start a free thirty day trial for our full service, which includes our ASX Research.