Buy Tabcorp At Current Levels

We retain our strong buy conviction on Tabcorp.

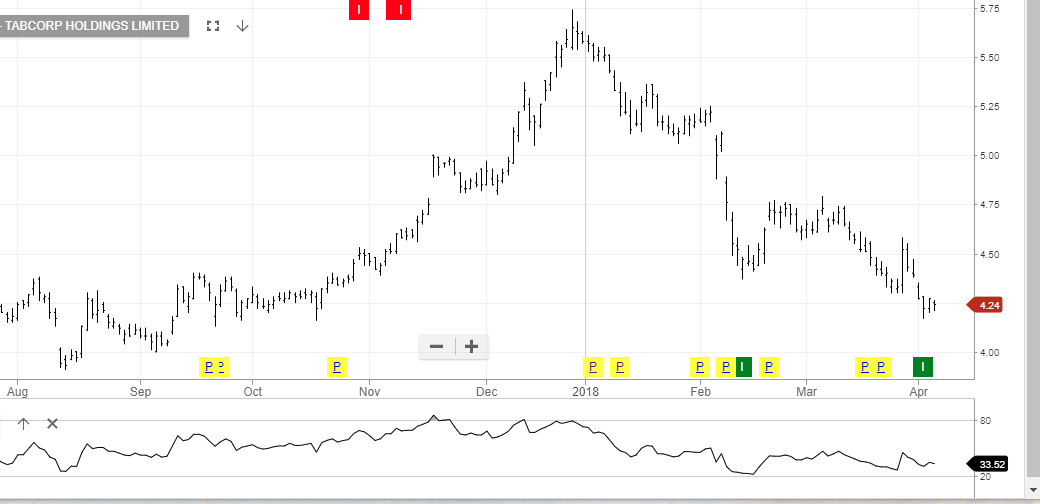

Cost savings following the Tatts merger and forecast improvement in August earnings are two key catalysts which support the recent Algo Engine buy signal at $4.22.

Tabcorp

We retain our strong buy conviction on Tabcorp.

Cost savings following the Tatts merger and forecast improvement in August earnings are two key catalysts which support the recent Algo Engine buy signal at $4.22.

Tabcorp

Our ALGO engine triggered a buy signal for TAH into yesterday’s ASX close at $4.22.

This “higher low” pattern is referenced to the $4.16 low posted on October 18th, 2017.

Since the company last reported earnings in February, the share price has dropped over 20%.

Technically, the price has reached oversold territory. Fundamentally, we feel investors are currently overlooking the cost savings of the newly merged company.

We believe TAH represents good value at in the $4.25 area and that shares will rally into the next earnings report scheduled in August.

TAH will also pay a 12.5 cent dividend in August, which pencils out to a 5.9% annual yield.

Tabcorp

We look at what the financials are likely to be in 2020; post the Tatts Group integration and cost savings.

FY20 revenue $5.5 billion, EBIT $880m, (FY17 was $325m) with underlying earnings growth of 6 – 8% per year and a forward dividend yield into 2020 of 5.5%.

Investors will be well served by tracking TAH for an upcoming entry point as the stock price re-bases near current levels.

TabCorp

We recommend buying Tabcorp as the price action retests the recent support level at $4.37.

Institutional money re-positioning ahead of the August earnings result will be the likely catalyst, which sees the share price trade back to the $5.25 level.

TAH goes ex-div $0.125 on the 11th of August.

TabCorp

The recent drop in Tabcorp shares provides a low risk entry level where future earnings are underpinned by the $110 million synergy cost savings after the Tatts merger.

The FY19 revenue is forecast to be $5.4billion, EBIT $850 milion, EPS, $0.28 and DPS $0.23, placing the stock on a forward yield of 4.9%, (fully franked).

Our ALGO engine triggered a buy signal in TAH on February 13th at $4.47.

TAH shares have reached a high of $4.74 in early trade and we see the next resistance level near $4.90

TabCorp

Shares of Tabcorp have dropped over 5% in early trade as H1 results were dampened by Tatts acquisition costs and weaker earnings from their UK start-up, Sun Bets.

The wagering giant posted a statutory net profit of $102 million, which was down 16% from a year ago. This included a $25.5 million charge in significant items related to the Tatts merger costs.

All together, the Tatts acquisition costs represented a one-off $59.3 million drag to the bottom line.

The company announced a fully franked interim dividend of 11¢ cents per share, payable on March 13.

We expected a much better H1 result for TAH and still believe the merger will prove profitable this year.

As such, we see value in the stock in the $4.80 area and expect the previous high price of $5.70 to be challenged over the medium-term.

Tabcorp

After reaching a 6-year high of $5.75 on December 27th, shares of TabCorp dropped over 10% to post an intra-day low of $5.10 on January 25th.

In our January 10th blog, we suggested that investors could look to buy TAH in the $5.20 area for a move back above $5.70 over the medium-term.

TAH will go ex-dividend for 12.5 cents per share on February 7th and report their first-half results the next day.

This will be the first look at the company’s results since the merger with Tatts Group and could show impressive growth guidance, as well as cost savings.

At the current price, the 12.5 cent dividend reflects a 4.7% annual yield.

We believe it’s reasonable to expect the TAH share price to firm into next week’s results with initial resistance in the $5.70 area.

TabCorp

TabCorp

Last week we mentioned that shares of TAH had reached overbought levels in the $5.75 area.

The share price has dropped 5 days straight and is now approaching the buy zone at $5.30.

We expect the synergy between TabCorp and Tatts to enrich the value of the company and believe TAH is a reasonable addition to investor portfolios for 2018.

TAH will go ex-dividend on February 7th for 12.5 cents per share. At $5.30 per share, this pencils out to a 4.7% yield.

TabCorp

Shares of TabCorp have rallied past our initial profit target of $5.25 and now look technically “overbought”

After trading as high as $5.73 on December 27th, the share price has backed off to $5.50.

We still like the growth prospects for TAH for 2018, and beyond, but suggest taking profits on long positions and looking buy on a pull back into the $5.20 area.

TabCorp

TabCorp

Australian Gaming stocks look set to move higher on increased seasonal interest and improved market conditions.

The three names we prefer in the gaming sector are: TAH, SGR and CWN.

Our ALGO engine triggered a buy signal in CWN on September 28th at $11.10. The company has gotten some bad press relating to machine tampering, but has rebounded as the accusations are being dismissed as “political fanfare.”

Our medium-term target on CWN is $12.75.

Shares of TAH have been firming off the $4.00 support area as the long-awaited merger with TTS enters the home stretch.

It’s widely believed that the government would like to consolidate corporate bookmaking and this merger would achieve that goal.

Our medium-term target for TAH is $5.25.

SGR is more of a technical play. After breaking out of a “triple top” pattern at $5.30 yesterday, the share price now has a upside measured target of $6.00.

Crown

Crown

TabCorp

TabCorp

Star Entertainment

Star Entertainment

Or start a free thirty day trial for our full service, which includes our ASX Research.