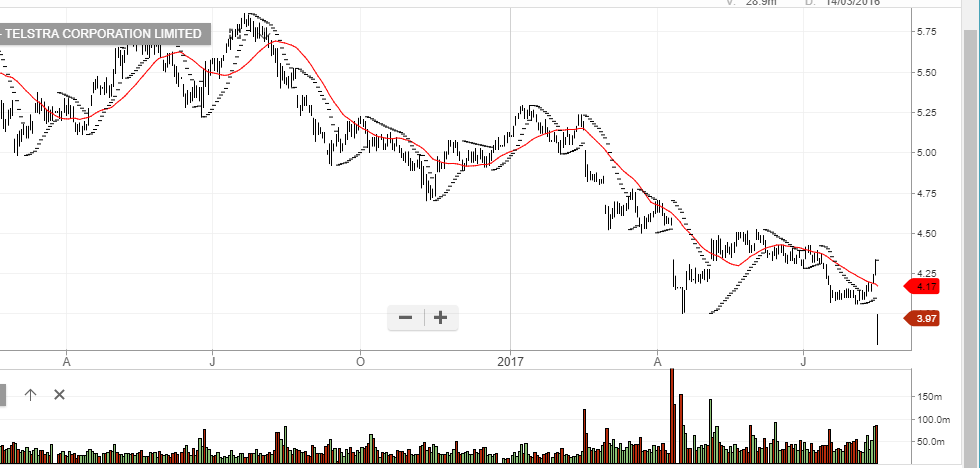

Can Telstra Shares Firm Into Ex-Dividend?

Since the release of their H1 earnings results on February 15th, shares of TLS have traded in a narrow 10 cent range between $3.40 and $3.50.

Looking past the $273 million impairment made against its Ooyala business, the growth in the TLS Enterprise and Whole businesses has been encouraging for top line growth.

The company reported earnings per share of 14.3 cents for the period and declared an interim fully franked dividend of 11 cents per share.

This was made up of a 7.5 cents per share ordinary dividend and a 3.5 cents per share special dividend.

The record date for both dividends is March 1, with payment then expected to be made on March 29.

It’s reasonable to expect some buying interest to come into the share price in front of the dividend date.

We prefer the long side of TLS at these levels and look for a return to the $4.00 handle over the medium-term.

Telstra

Telstra

Telstra

Telstra Telstra

Telstra

Telstra

Telstra Telstra

Telstra