Buy UniBail-Rodamco-Westfield

UniBail-Rodamco is the European property conglomerate which acquired the global shopping center giant, Westfield.

As UniBail continues consolidating their expanded portfolio, investors can expect to hear more about “non-core” asset sales.

The long-term play for UniBail is to keep the best of the high quality assets from the combined groups.

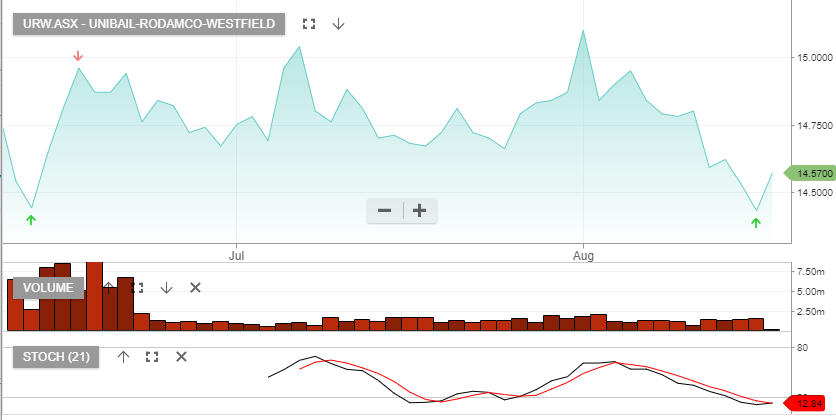

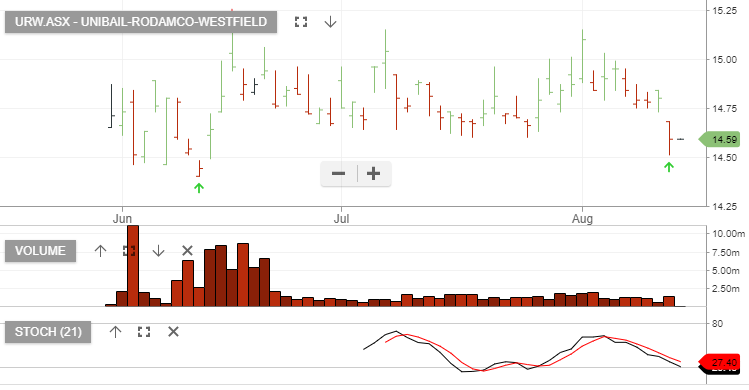

A combination of higher bond yields and impatient retail investors have seen the stock price fall to $12.50.

This places URW on a 6% yield and we’re now looking at a share price that should start to find institutional buying interest.

Unibail