Westpac: FY22 Earnings Review

Westpac Banking reported FY22 earnings of $7.195bn which is up 12% on the same time last year. Total FY23 dividends $1.42 which represents a payout ratio of 70%.

WBC announced they will commence a $1.5bn on-market share buyback.

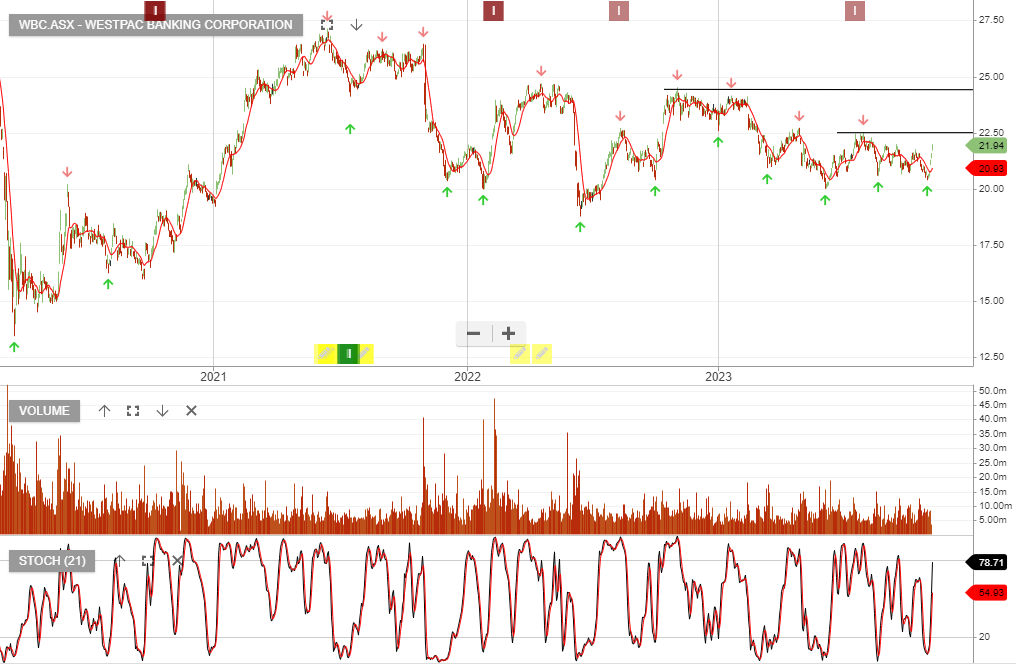

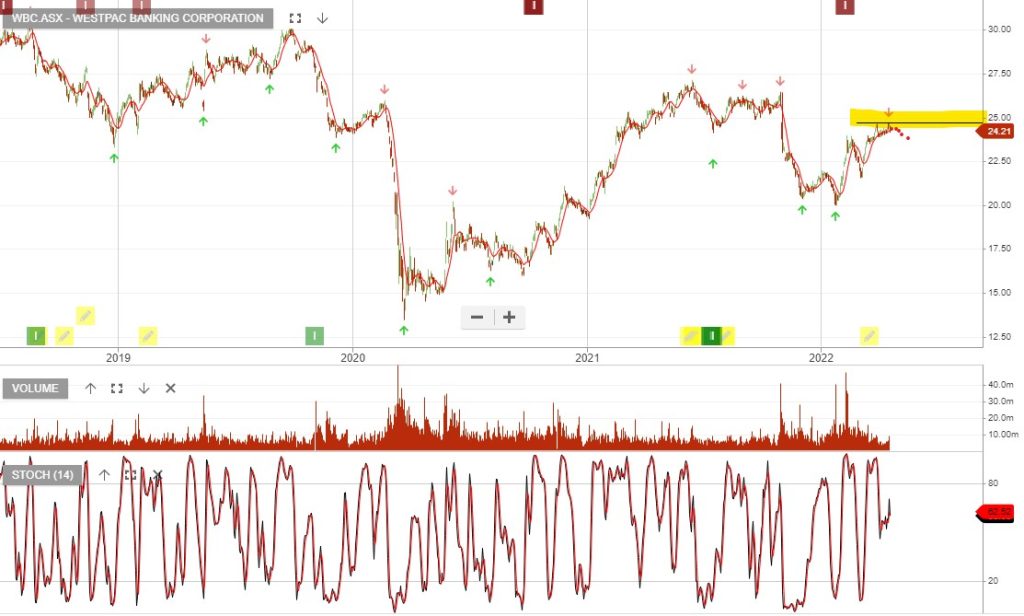

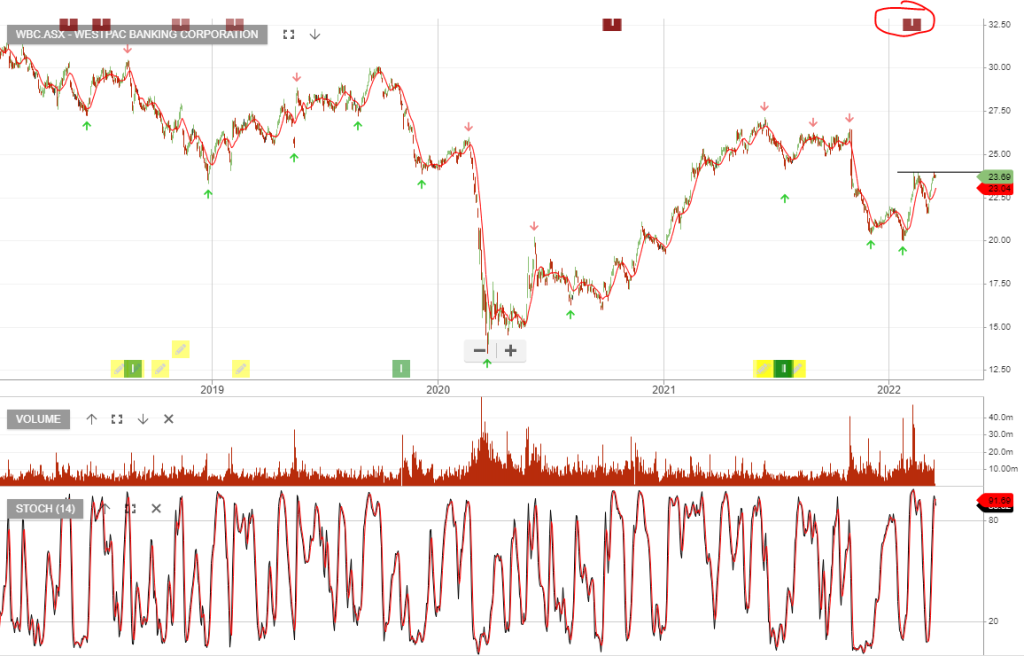

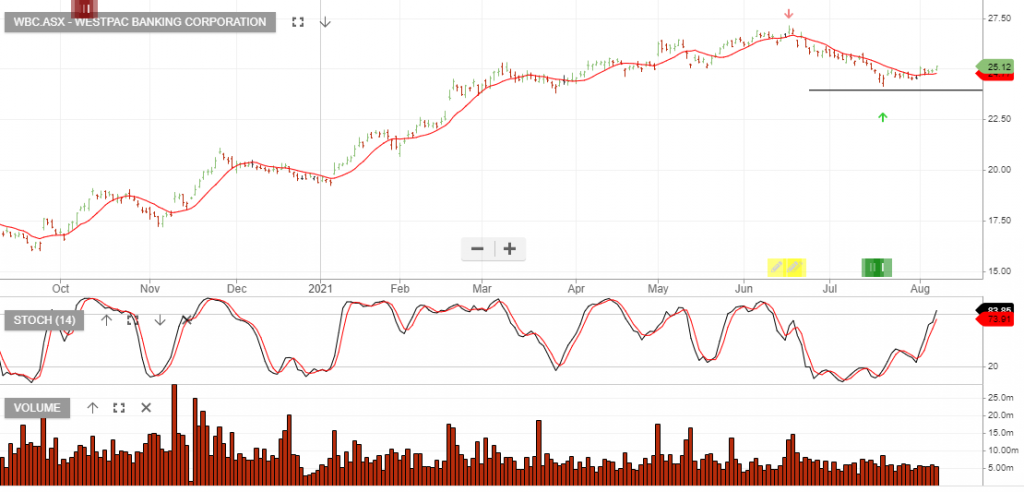

Westpac

Westpac