ALGO UPDATE: A New Buy Signal In WFD

Shares of WFD are firming today after yesterday’s earnings report failed to inspire any material buying interest.

The company posted a 13.5 % rise in annual profit to US$1.55 billion, shrugging off tough retail conditions and competition from online platforms like Amazon.

Revenue for the year to December 31st rose 17.1% to US$2.1 billion.

Some reports have noted that the lack of specific earnings guidance in yesterday’s announcement has somewhat tempered fresh buying interest.

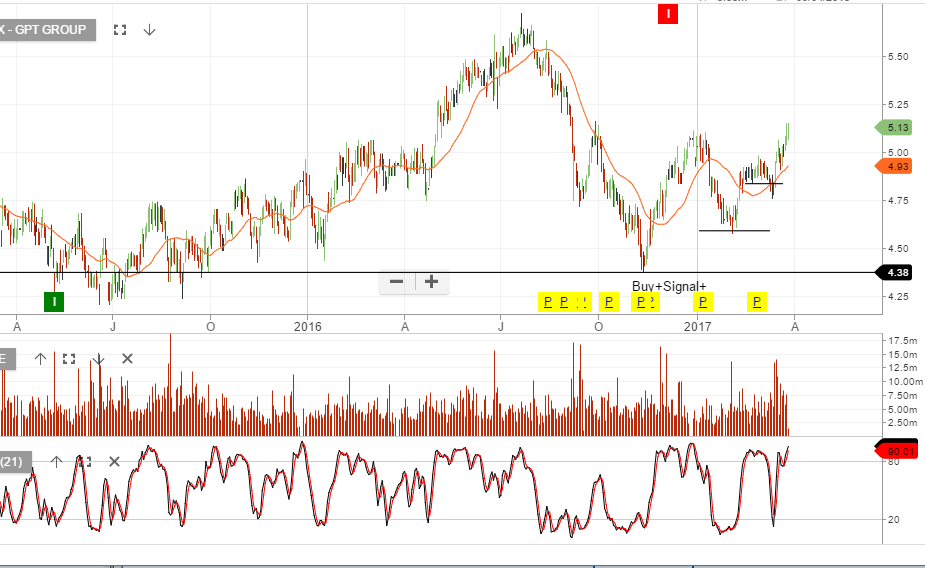

WFD was added to our Top 20 model portfolio on February 7th at $8.89 and our ALGO engine triggered a buy signal for WFD on February 13th at $8.55.

From a technical perspective, there is a momentum switch-point at $8.75, a break of this price level suggest an extension back into the $9.00 handle.

Westfields

Westfields

Westfield

Westfield