Woolworths Investor Update

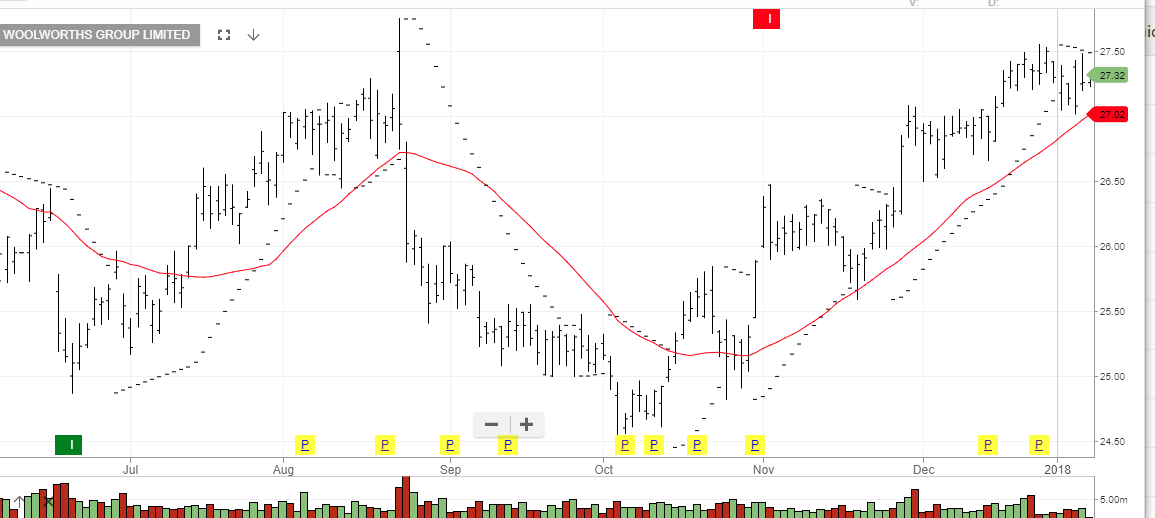

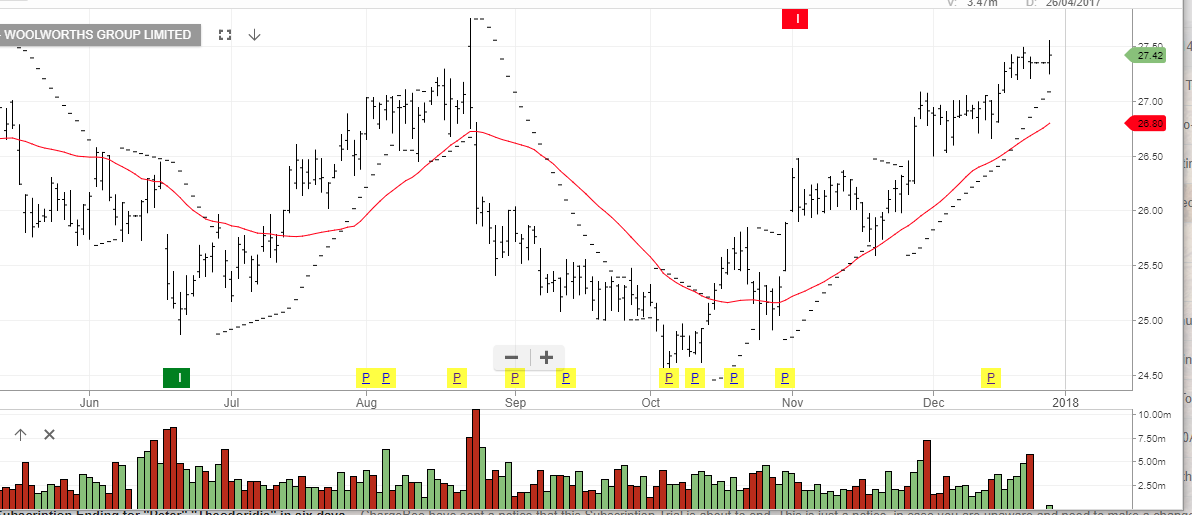

Whilst the grocery industry’s profitability is improving, (as the industry becomes more rational), we’re cautious on Woolworths’ share price due to valuation concerns.

Industry analysis shows Woolworths sales momentum is slowing. With the stock now trading 23 x consensus FY19 earnings, on a forward yield of 3.3%, there seems little margin for disappointment.

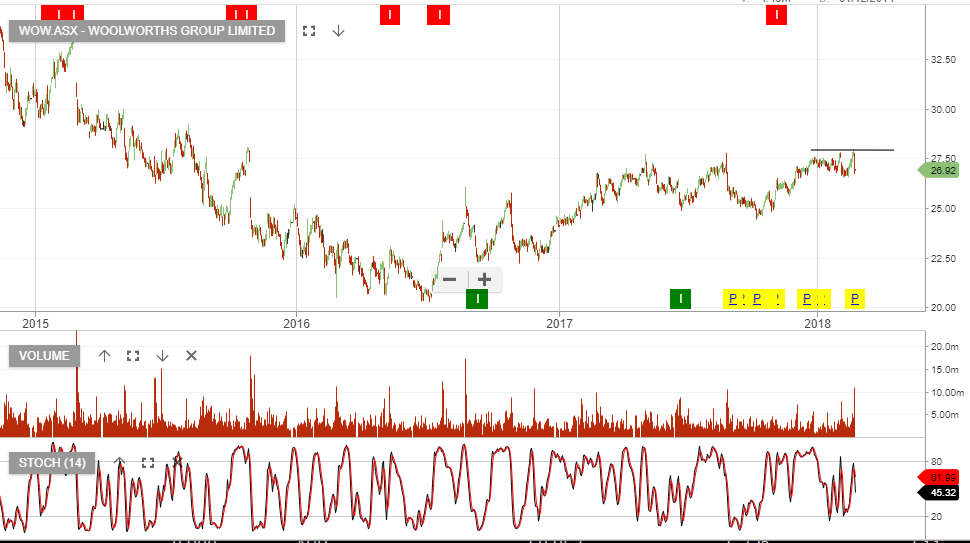

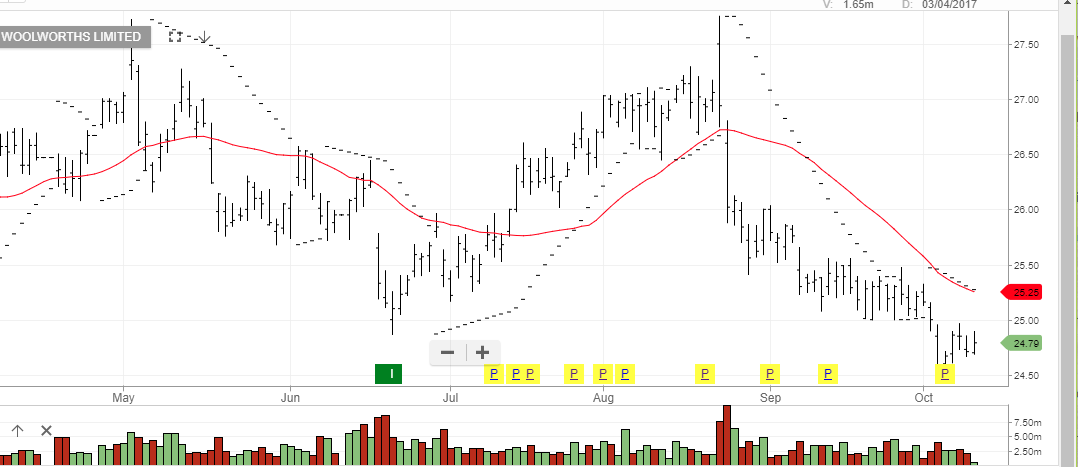

We continue to track Woolworths for a new “higher low” formation, at which point the stock will be added into the ASX 50 model at a discount to the current trading range.