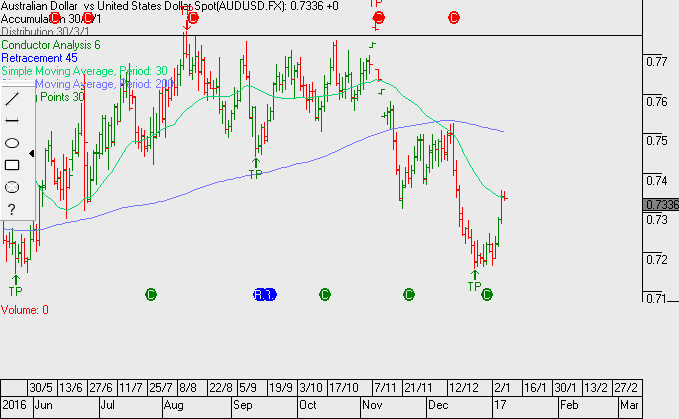

ETF UPDATE: Aussie Dollar Pointing Lower

Since early January, the AUD/USD has traded in a 250 point range between .7500 and .7750.

Now that the FED has raised rates this year (and has given guidance for more tightening) the yield differential between the overnight rates between Australia and the USA has narrowed to just 50 basis points.

This compares to 200 basis points this time last year.

In addition, with domestic employment growth sputtering and lower inflation readings, the RBA has maintained an easing bias for overnight rates in Australia.

This strengthens the case for the AUD/USD to trade lower and return to the December lows of .7150.

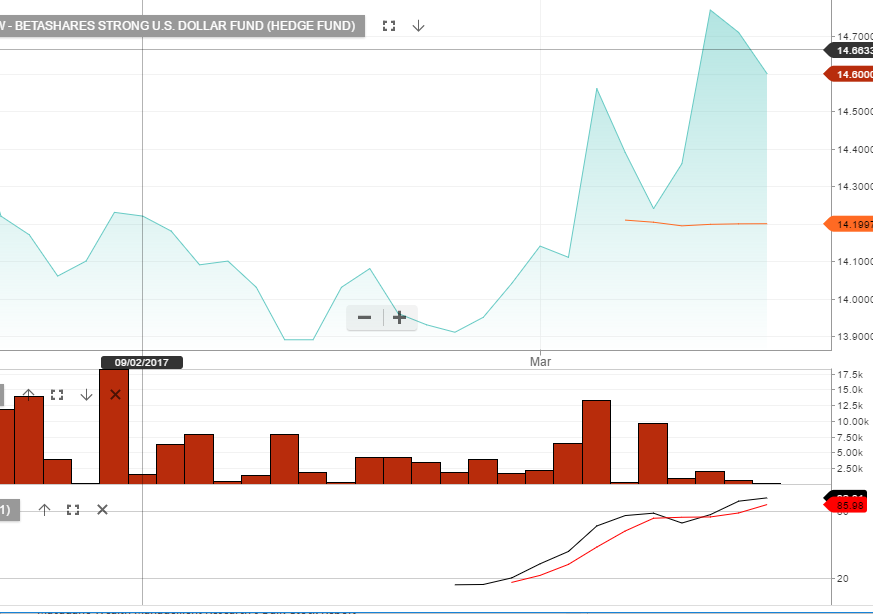

Investors looking to profit from a falling AUD/USD have been buying the BetaShare YANK Exchange Traded Fund (ETF). The current unit price of YANK is $14.10.

We estimate that a move back to the December low of .7150 would increase the unit value of YANK to approximately $16.75.