Evolution – June Quarter Results

Evolution Mining reported June quarter production in-line with market estimates and FY20 guidance remains flat at $725koz – $ 775koz.

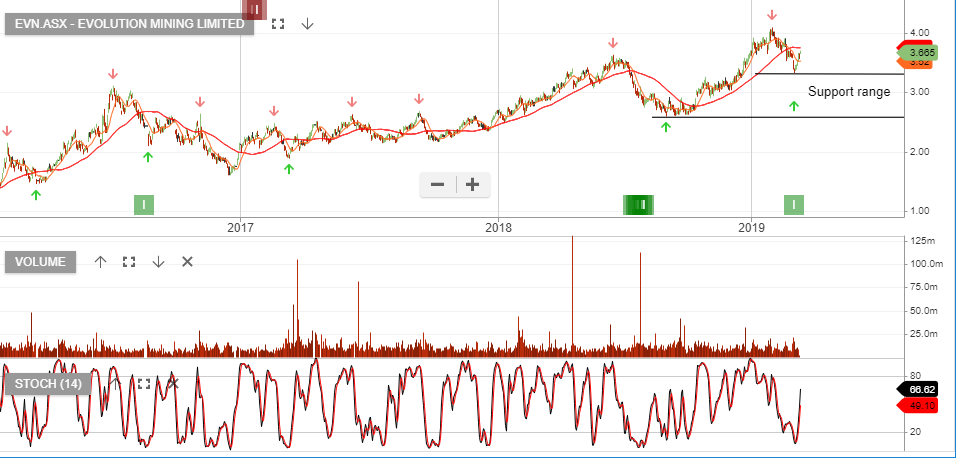

The reversal in yesterday’s share price action can be attributed to flat production growth and higher operating expenses. FY20 all-in costs increase by 5% to A$890 – $915oz.

Production capex increases to support development at Cowal and Mt Calton.

We have EVN trading on 3% forward yield and continue to see opportunities for NST, EVN, OGC and GOR within the gold space.

Northern Star

Northern Star Evolution Mining

Evolution Mining