Gold Jumps On North Korean Missile Launch

Earlier this morning, North Korea launched a ballistic missile that flew over the Northern part of Japan and landed in the Pacific near Hokkaido.

The missile was fired from the Sunan region around 7:30 am, Sydney time, and flew approximately 2,700 km at an altitude of about 550 km.

Both South Korea and Japan responded with a strong statement denouncing Pyongyang’s sharp escalation of tensions in the region.

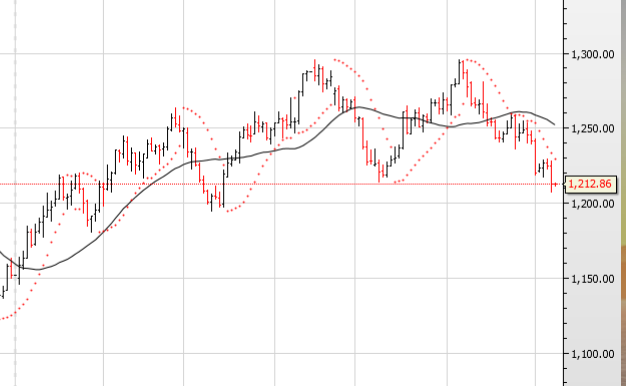

Gold was already $12.00 higher after the US session and added another $8.00 after the news broke this morning. As illustrated on the chart below, spot Gold broke above a 7-year downtrend line and reached a high of $1324.50.

In an environment of global economic uncertainty and heighten geo-political tensions, we still prefer the long side of Gold and see the next resistance level at $1340.00

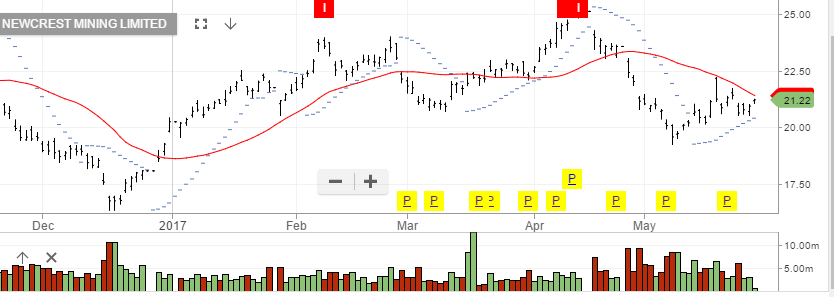

We still see scope for more upside in the local Gold names. Both Newcrest and Evolution are trading over 2.5% higher in early trade. We consider an upside target of $23.60 in NCM and $2.95 in EVN as reasonable price targets.

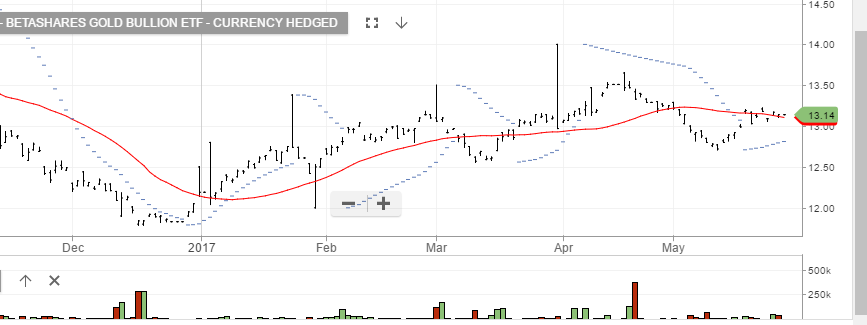

Spot Gold

Spot Gold

Newcrest Mining

Newcrest Mining

Evolution Mining

Evolution Mining

Spot Gold

Spot Gold Newcrest Mining

Newcrest Mining Evolution Mining

Evolution Mining Gold

Gold Newcrest.

Newcrest. Evolution Mining

Evolution Mining

Newcrest Mining

Newcrest Mining