ETF Watch: Aussie Dollar Pushed Lower After RBA Comments.

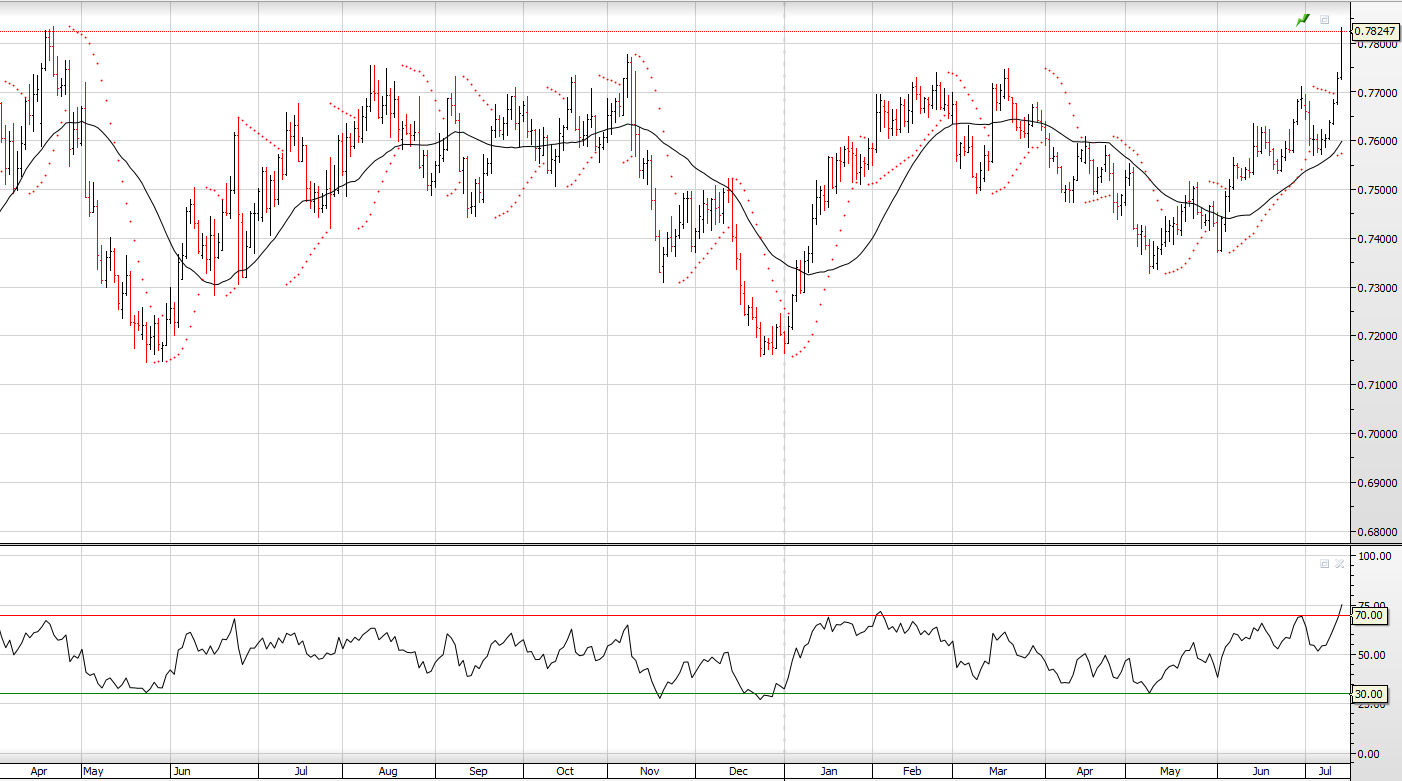

Comments included in the RBA minutes about the level of the Aussie Dollar were the catalyst for the 1.0% drop in the AUD/USD overnight.

The central bank doubled-down on their concerns that the recent rise in the currency has hindered exports and been felt in domestic consumption data.

Internal momentum indicators are pointing lower as the price support level at .7825 was broken in late NY trade.

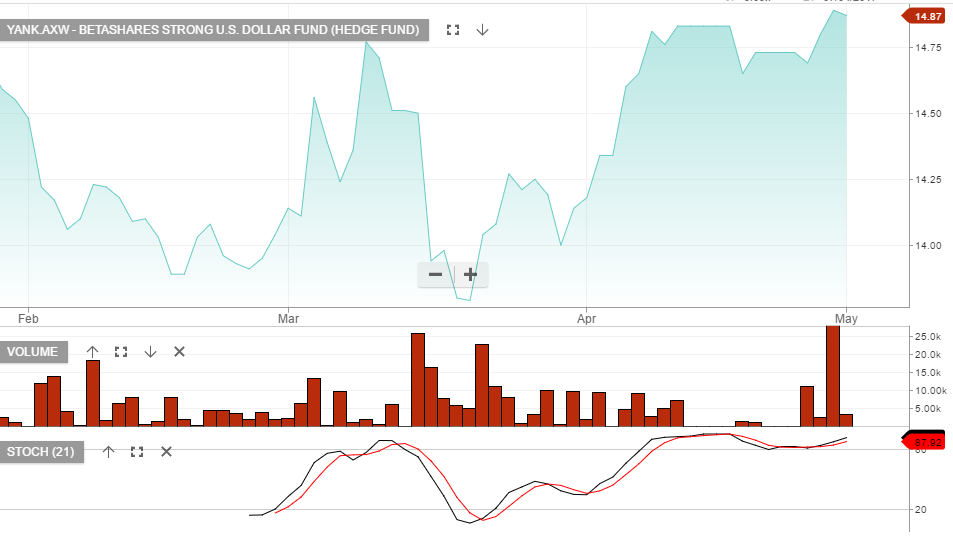

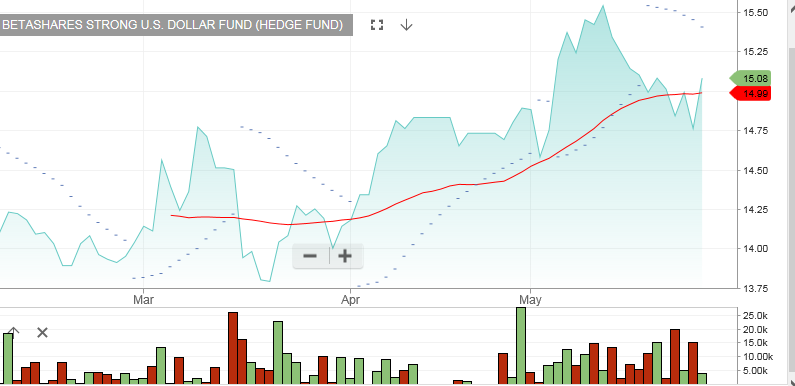

Investors looking to profit from the AUD/USD trading lower can look to buy the BetaShare ETF with the symbol: YANK.

YANK is an inverse ETF, which means the unit price increases as the price of the AUD/USD decreases.

YANK also has a 2.5% weighting, which means a 1% change in the AUD/USD will correspond to a 2.5% move in the unit price.

The current price of YANK is $13.05. We calculate that when the AUD/USD trades back to the January low near .7300, the unit price will trade at $16.75.

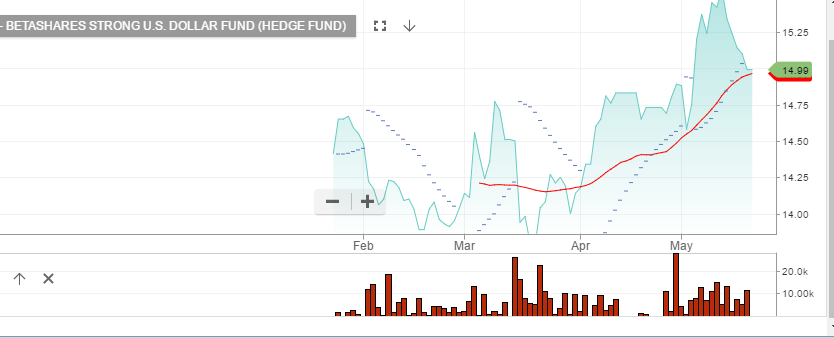

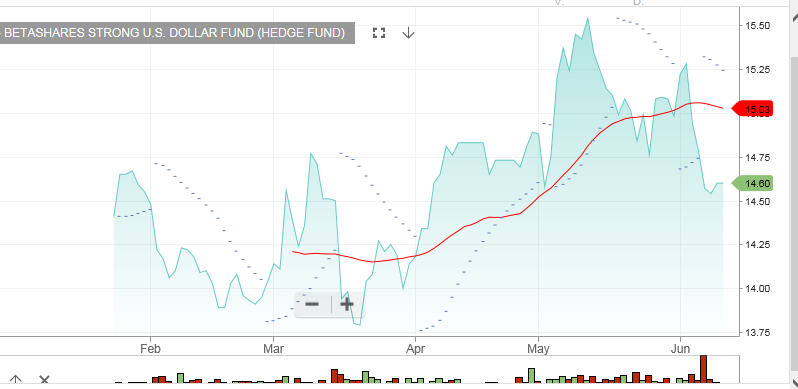

BetaShare

BetaShare ETF: YANK

BetaShare ETF: YANK BetaShare YANK ETF

BetaShare YANK ETF