Woolworths (WOW.ASX) EBIT was down 36% to $2.5b from the same time last year. NPAT (normalised) was $1.55b and NPAT, on a reported basis including write downs, came in at a loss of $1.2b.

FY17 food & liquor should begin to show positive growth and based on FY17 EPS of $1.20 and DPS of $0.80, Woolworths is now trading on a forward yield of 3.3%.

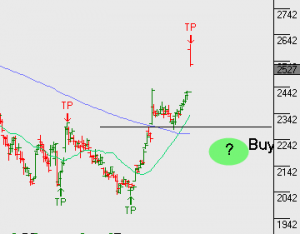

We see Woolworths breaking out of the 18 month downtrend and beginning a new technical structure of higher highs and higher lows. We collected call premium over recent time and intentionally left the stock uncovered coming into this result. With the stock now back at our fair value target, we look to sell covered calls at or near the $26 range into November or December.